Vittoria Tripodi registered as a financial adviser several years ago. An income statement for the current period,

Question:

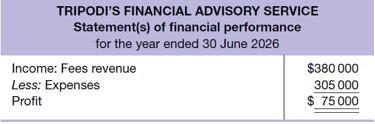

Vittoria Tripodi registered as a financial adviser several years ago. An income statement for the current period, prepared using cash accounting, is presented below. GST is ignored.

Additional data 1. Fees for advice given for the year ended 30 June 2025 for $8000 were collected in the current year and are included above.

2. Fees earned in the current year of $12 000 are expected to be collected in the following year. These have not been included above.

3. Accrued salaries at 30 June 2025 and 2026 are $4000 and $4300, respectively.

4. Depreciation expense of $18 000 is not included in the expenses.

5. Vittoria Tripodi withdrew $2400 per month to cover personal living expenses.

Required

(a) Using the above information, prepare an income statement on the accrual basis. Show all calculations.

(b) Briefly explain why the revised statement could be considered a better measure of profit.

(c) Is it a correct accounting procedure to exclude drawings from expenses? Explain why.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie