Bryan and Stacey are in partnership with fixed capitals of $200 000 and $150 000, respectively. The

Question:

Bryan and Stacey are in partnership with fixed capitals of $200 000 and $150 000, respectively. The partners do not have a formal agreement about how to share profits and losses, although salaries for each have been agreed, as well as interest on capital of 5 percent per year.

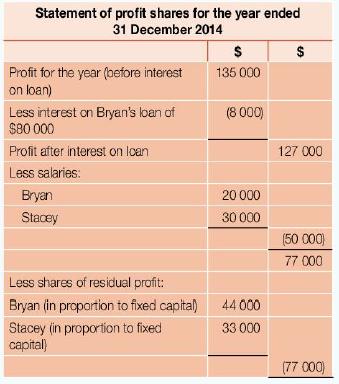

During the year ended 31 December 2014, the partnership was profitable and Bryan made an attempt to show Stacey how he thought the profits should be shared. The following statement was prepared by Bryan:

Stacey does not agree with Bryan's ideas about how the profits should be shared.

Assuming Bryan and Stacey cannot agree, calculate how the profit for the year ended 31 December 2014 should be shared between the partners.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone