Rex Limited manufactures plastic storage boxes. The directors are considering buying a new, more efficient moulding machine

Question:

Rex Limited manufactures plastic storage boxes. The directors are considering buying a new, more efficient moulding machine to replace the existing machine. The new machine will increase output by 25 per cent. The company's profit for the year ended 31 December 2014 was $45 000.

The new machine will cost $160 000, it will have an estimated useful life of four years and will have a residual value of $40 000 at the end of four years.

The company's bank has agreed to provide a loan to purchase the machine, repayable over four years. Annual loan repayments, including interest of $15 000, would be $55 000 per annum.

If the company purchases the new machine:

• Staff training at a cost of $8000 will be required in the first year

• Fixed costs will be $80 000 per annum, including straight-line depreciation of $30 000 per annum

• Maximum capacity of 10,000 storage boxes per month will be achieved immediately

• Maintenance of the new machine is expected to cost $2000 in the first year and is expected to increase by $1000 in each subsequent year

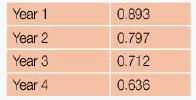

▪ Contribution per storage box will be $1.35. The company's cost of capital is 12 per cent and the following discount factors apply.

Required

a. Calculate the profit for year 1 if the directors purchase the new machine.

b. Calculate the annual cash flows for each of the four years.

c. Calculate the payback period of the new machine in years and days.

d. Calculate the net present value of the new machine.

e. Advise the directors whether or not they should purchase the new machine. Justify your answer.

f. State two other capital investment appraisal techniques that the directors could use to aid their decision.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone