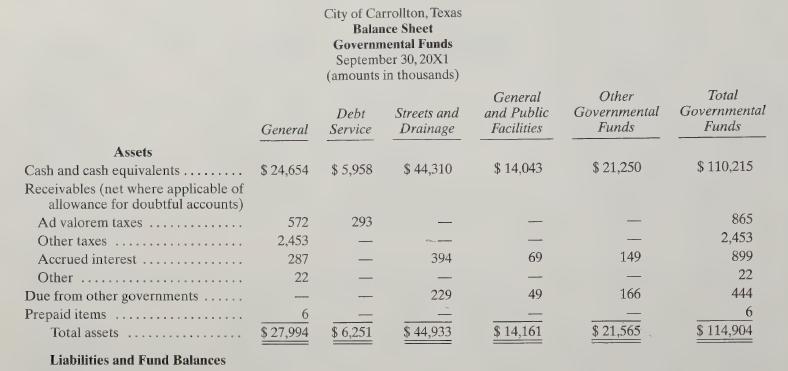

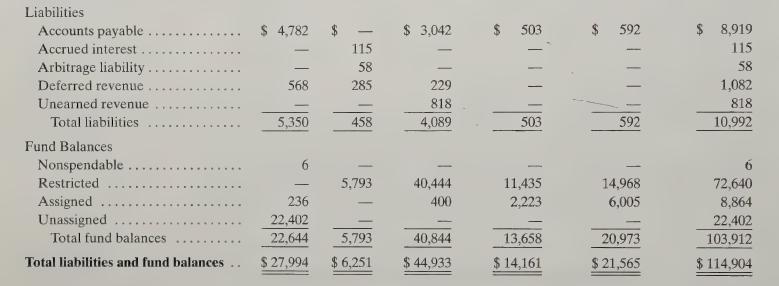

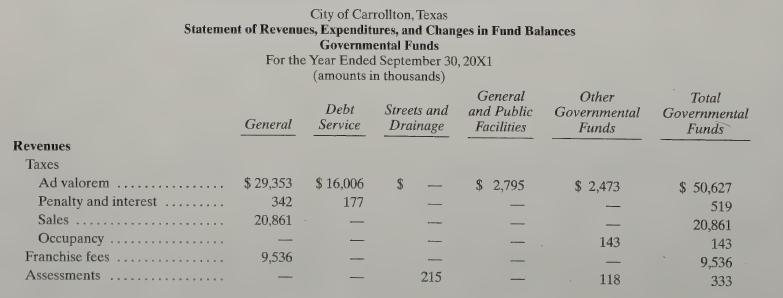

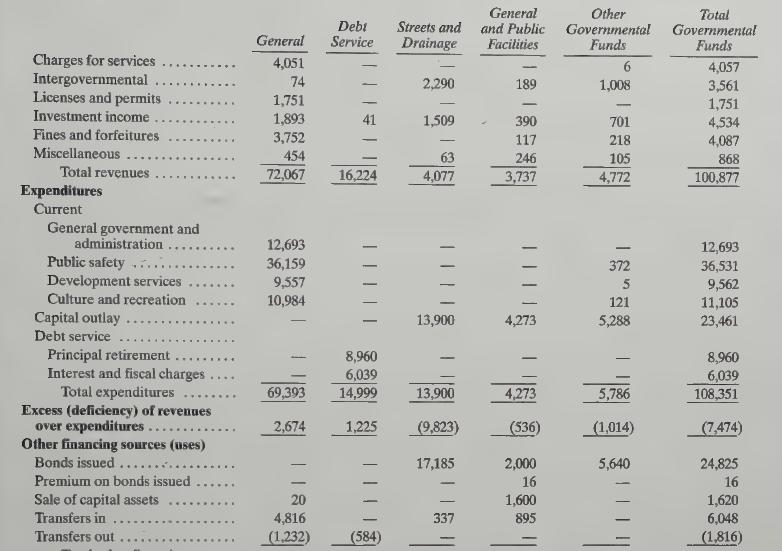

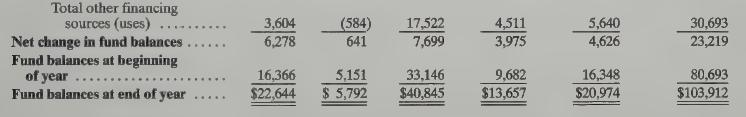

Presented on the following page are the governmental fund financial statements of the City of Carrollton, Texas

Question:

Presented on the following page are the governmental fund financial statements of the City of Carrollton, Texas (adapted from a recent CAFR). All amounts are reported in thousands of dollars.

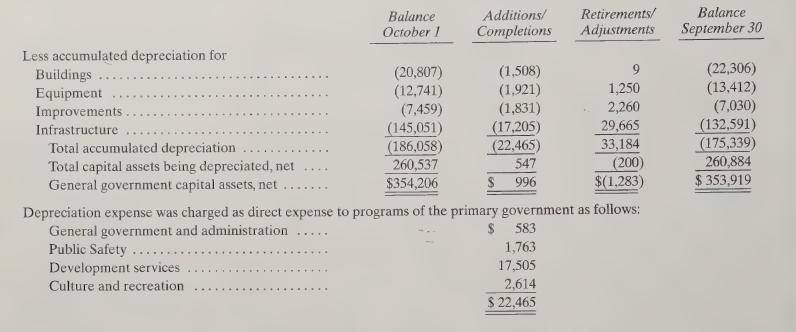

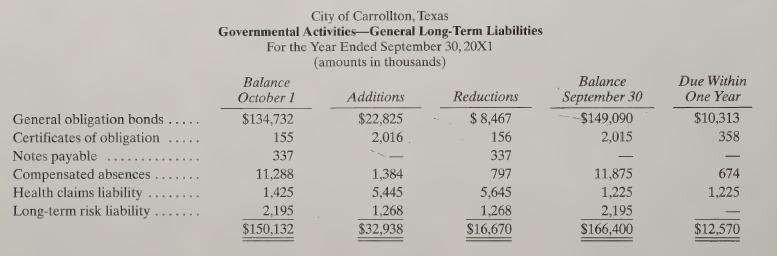

1. Interest to be accrued on long-term debt is $948.

2. All of the deferred revenue resulted from property taxes not being collected within the 60-day availability period. Also, $564 in property tax revenue was deferred in last year’s fund statements. ‘

3. The net increase in long-term compensated absences payable, health claims liability, and long-term risk liability is allocable to the governmental functions as follows: 20%, general government; 50%, public safety; and 15% each for development services and culture and recreation.

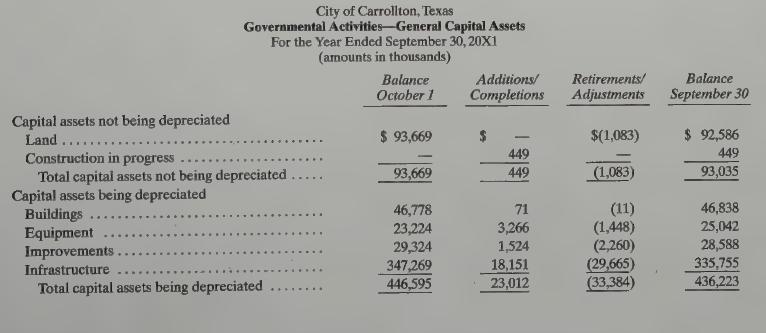

4. The proceeds from the sales of capital assets were for all retirements that occurred in the 20X0-20X1 fiscal year.

5. Interest expenditures of $767 reported in the 20X0 fiscal year were properly accrued in the previous fiscal year.

6. The net of all transfers were from the Enterprise Funds.

Required Prepare each of the following for the City of Carrollton as of September 30, 20X1.

a. Governmental Funds Balance Sheet Conversion Worksheet.

b. Total Fund Balance to Total Net Assets reconciliation.

Step by Step Answer:

Governmental And Nonprofit Accounting Theory And Practice

ISBN: 9780132552721

9th Edition

Authors: Robert J Freeman, Craig D Shoulders, Gregory S Allison, Terry K Patton, Robert Smith,