The City of Lynn operates its municipal airport. The trial balance of the Airport Fund as of

Question:

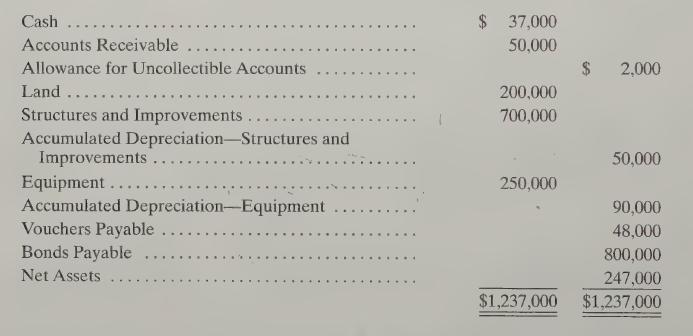

The City of Lynn operates its municipal airport. The trial balance of the Airport Fund as of January 1, 20X0, was as follows:

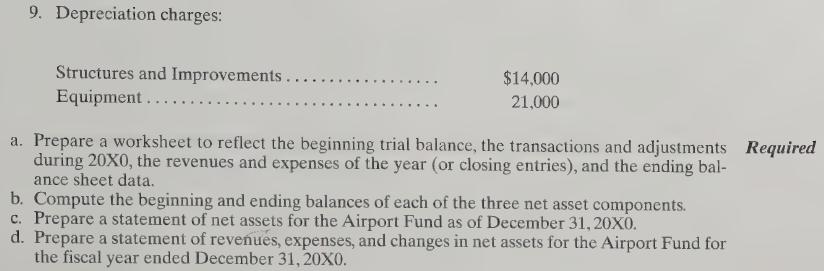

The following transactions took place during the year: 1. Revenues collected in cash: aviation revenues, $340,500; concession revenues, $90,000; revenues from airport management, $30,000; revenues from sales of petroleum products, $10,500. 2. Expenses (all paid in cash with the exception of $24,000, which remained unpaid at December 31) were operating, $222,000; maintenance, $75,000; general and administrative, $73,000. 3. Bad debts written off during the year, $1,900. 4. The vouchers payable outstanding on January 1, 20X0, were paid. 5. Bond principal paid during the year, $50,000, along with interest of $40,000. 6. The remaining accounts receivable outstanding on January 1, 20X0, were collected. 7. Accounts receivable on December 31, 20X0, amounted to $30,000, all applicable to aviation revenues, of which $1,400 is estimated to be uncollectible. 8. Accrued interest payable at the end of the year, $3,000.

Step by Step Answer:

Governmental And Nonprofit Accounting Theory And Practice

ISBN: 9780132552721

9th Edition

Authors: Robert J Freeman, Craig D Shoulders, Gregory S Allison, Terry K Patton, Robert Smith,