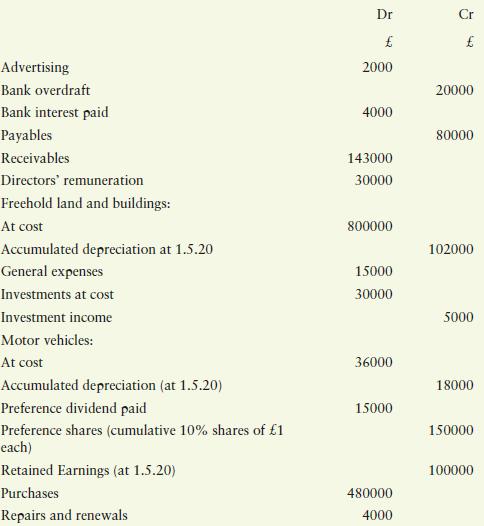

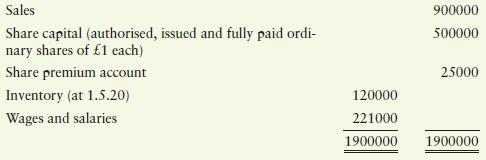

The following trial balance has been extracted from Carol Ltd as at 30 April 2020: Additional information:

Question:

The following trial balance has been extracted from Carol Ltd as at 30 April 2020:

Additional information:

1. Inventory at 30 April 2020 was valued at £140,000.

2. Depreciation for the year of £28,000 is to be provided on buildings and £9000 for motor vehicles.

3. An accrual of £6000 is required for the auditors’ remuneration.

4. £2000 had been paid in advance for renewals.

5. Corporation tax owing at 30 April 2020 is estimated to be £60,000.

6. The directors proposed an ordinary dividend of 10p per share after the year end.

7. The market value of the investments at 30 April 2020 was £35,000.

Required:

Prepare Carol Ltd’s trading and statement of profit or loss and statement of retained earnings for the year to 30 April 2020 and a statement of financial position as at that date.

Advertising Bank overdraft Bank interest paid Payables Receivables Directors' remuneration Freehold land and buildings: At cost Accumulated depreciation at 1.5.20 General expenses Investments at cost Investment income Motor vehicles: At cost Accumulated depreciation (at 1.5.20) Preference dividend paid Preference shares (cumulative 10% shares of £1 each) Retained Earnings (at 1.5.20) Purchases Repairs and renewals Dr £ 2000 4000 143000 30000 800000 15000 30000 36000 15000 480000 4000 Cr £ 20000 80000 102000 5000 18000 150000 100000

Step by Step Answer:

Note that ordinary dividends declared after the yearend are only disclosed in th...View the full answer

Accounting For Non Accounting Students

ISBN: 9781292286938

10th Edition

Authors: John Dyson, Ellie Franklin

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The following trial balance has been extracted from Carol Ltd as at 30 April 2012: Additional information: 1. Stock at 30 April 2012 was valued at 140,000. 2. Depreciation for the year of 28,000 is...

-

The following trial balance has been extracted from the ledger of Andrea Howell, a sole trader, as at 31 May 20X3, the end of her most recent financial year. The following additional information as...

-

The following trial balance has been extracted from the ledger of Smart Business Sdn Bhd: Smart Business Sdn Bhd Trial Balance as at 30 June 2018 Debit Credit RM RM Sales ..........450,000 Opening...

-

What is the importance of collecting and interpreting data and information about competitors? What practices should a firm use to gather competitor intelligence and why?

-

Conduct a survey in which you ask 20 people the two scenarios presented in Thought Question 5 at the beginning of this chapter and discussed in Section 17.5. Record the percentage who choose...

-

The fundamental frequencies of two air columns are the same. Column A is open at both ends, while column B is open at only one end. The length of column A is 0.70 m. What is the length of column B?

-

You are designing an accelerated system that performs the following function as its main task: Assume that the accelerator has the entire pix and f arrays in its internal memory during the entire...

-

Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio Dell Inc., headquartered in Austin, Texas, is the global leader...

-

The following graph shows the approximate value of home prices and existing home sales as a percentage change from 2003, together with quadratic approximations, such that: Home prices: 40 Home prices...

-

Repeat Prob. 2.75 for the eight-way divider shown in Fig. 2.136 . Prob 2.75 Find R ab in the four-way power divider circuit in Fig. 2.135. Assume each R = 4 Ω. inIim LinLw Lui bo ww- ww-...

-

What is a debenture loan?

-

The following balances have been extracted from the books of Jim Ltd as at 31 March 2020: Additional information 1. Inventory at 31 March 2020 was valued at 14,000. 2. Furniture and fittings and...

-

Why does government spending crowd out government purchases?

-

You have been assigned to look into ICICI banks governance plan( which is one of the 6 disciplines of customer experience design. As a customer experience specialist ,answer the below questions in...

-

1. How would you characterize the strategy pursued by GM in the (a) developing world and (b) Europe before 1997? 2. What do you think were the likely competitive effects of the pre-1997 strategy? 3....

-

1. Provide an example or analogy to illustrate the efficiency, effectiveness, and impact in the context of talent and HR decision-making. 2. Briefly describe the People Equity, or ACE, model...

-

A team of 3 employees is preparing 20 reports. It takes Mary 30 minutes to complete a report, and it takes Matt 45 minutes to complete a report. All reports are completed in 4 1/2 hours. How long...

-

Define supportive leadership behaviors and list their effectiveness (positive). Provide two specific and detailed hospitality leadership examples; Explain why those behaviors are effective in your...

-

What is the main idea meant by arm's length distance in accounting? Explain what is an arm's length when a company purchases a couch for the office from a supplier.

-

On January 2, 20X3, Sheldon Bass, a professional engineer, moved from Calgary to Edmonton to commence employment with Acco Ltd., a large public corporation. Because of his new employment contract,...

-

Distinguish between one-price and flexible-price policies. Which is most appropriate for a hardware store? Why?

-

What pricing objective( s ) is a skimming pricing policy most likely implementing? Is the same true for a penetration pricing policy? Which policy is probably most appropriate for each of the fo...

-

How would differences in exchange rates between different countries affect a firms decisions concerning the use of flexible-price policies in different foreign markets?

-

35. Lisa plans to go to College in 2 years. Listed below are Lisa's current income and her expense information. Net Income: $850/month Clothing: $75/month Food: $45/week Entertainment: $55/week...

-

Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided...

-

Materials Conversion Units Beginning work in process inventory 72,000 Percent Complete 70% Percent Complete 30% Units started this period 382,000 Completed and transferred out 360,000 Ending work in...

Study smarter with the SolutionInn App