Question:

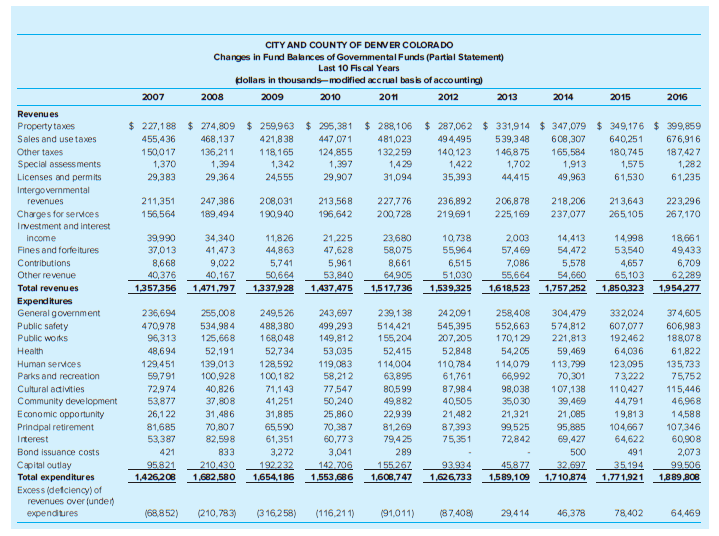

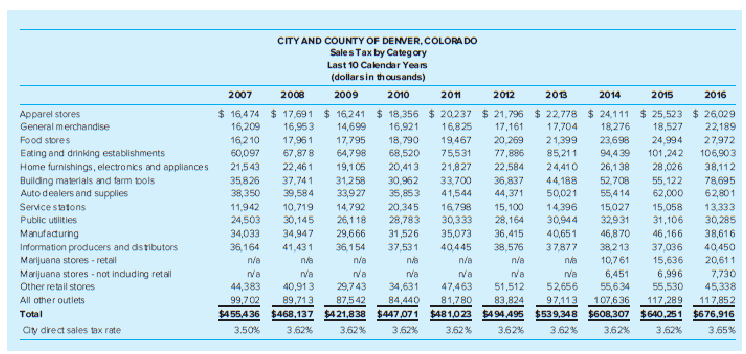

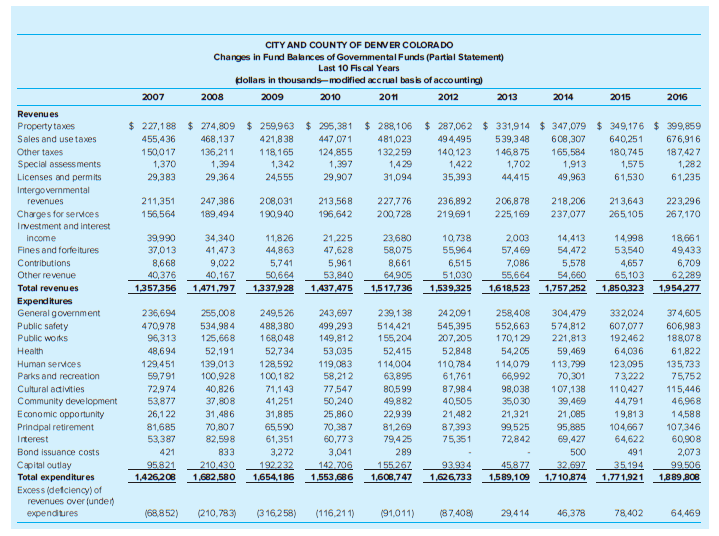

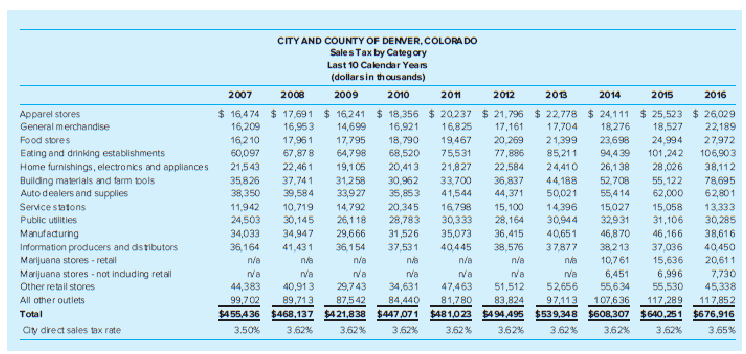

The MD&A for the 2016 City and County of Denver CAFR is included as Appendix B in this chapter. Following are two tables that have been adapted from the statistical section of the CAFR. Use the MD&A and the provided statistical tables to complete this case.

Required

a. What are the three largest sources of governmental funds revenue? What percentage of the governmental funds revenue is from each of these sources?

b. Sales tax is a large part of Denver's tax revenue. Using information from the MD&A and trend information from both statistical tables provided, discuss trends in Denver's sales tax revenues and your projection for sales tax revenues over the next two to three years.

c. What are the three largest sources of governmental funds expenditures? What percentage of the governmental funds expenditures does each of the three sources represent and what has been the trend for each over the past few years?

d. Compare the growth in revenue to the growth in expenditures over the past 10 years. Discuss any changes in the overall expenditure growth patterns you have seen and would expect to see over the next two to three years.

Transcribed Image Text:

CITY AND COUNTY OF DENVER COLORA DO Changes in Fund Balances of Govemmental Funds (Partial Statement) Last 10 Fis cal Years dollars in thousands-modified accrual basis of accounting) 2011 2008 2009 2012 2015 2007 2010 2013 2014 2016 Revenues $ 227,188 $ 274,809 $ 259,963 $ 295,381 447,071 $ 288,106 $ 287,062 $ 331,914 $ 347,079 $ 349,176 $ 399,859 539,348 Property taxes Sales and use taxes 455,436 150,017 1,370 468,137 421,838 481,023 494,495 6 08,307 640,251 676,916 146,8 75 1,702 Other taxes Special assess ments Licenses and permits 136,211 118,165 1,342 24,555 124,855 132,259 1,4 29 140,123 1,422 165,584 180,745 187,427 1,394 1,397 1,913 1,282 1,575 29,383 29,364 29,907 31,094 35,393 49,963 61,530 61,235 44,415 Intergovermmental 211,351 247,386 208,031 213,568 227,776 236,892 206,878 218,206 213,643 223,296 revenues 225,169 Chages for serMces 189,494 190,940 196,642 200,728 219,691 237,077 265,105 267,170 156,564 Investment and interest 11,826 44,863 39,990 37,013 34,340 41,473 21,225 47,628 23,680 10,738 55,964 2,003 57,469 7,086 14,413 54,472 14,998 53,540 18,661 49,433 income Fines and forfeitures 58,075 Contributions Other revenue 8,668 9,022 5,741 5,961 8,661 6,515 51,030 1,539,325 5,578 4,657 6,709 53,840 64,905 1,517,736 55,664 1,618,523 40,376 1,357,356 40,167 1,471,797 50,664 1,337,928 54,660 1,757,252 65,103 1,850,323 62,289 1,954,277 Total revenues 1,437,475 Expenditures General government Public safety 249,5 26 236,694 255,008 243,697 239,138 242,091 258,408 304,479 332,024 37 4,605 470,978 534,984 125,668 488,380 499,293 149,812 514,421 545,395 207,205 552,663 170,1 29 574,812 221,813 607,077 192,462 606,983 96,313 168,048 155,204 188,078 Public works 48,694 52,191 52,734 53,035 52,415 52,848 54,205 59,469 64,036 61,822 Health 129,451 59,791 139,013 100,928 128,592 100,182 119,083 58,212 114,004 110,784 61,761 114,079 113,799 70,301 123,095 73,222 135,733 75,752 Human servces Parks and recreation 63,895 66,992 Cultural adivities 72,974 40,826 37,808 71,143 41,251 80,599 87,984 40,505 98,038 35,030 107,138 110,427 44,791 115,446 77,547 53,877 Community development Economic opportunity 50,240 49,882 39,469 46,968 26,122 31,486 70,807 31,885 65,590 25,860 22,939 21,482 21,321 21,085 19,813 14,588 81,685 53,387 70,387 60,773 81,269 79,4 25 87,393 75,351 99,525 95,885 69,427 104,667 64,622 107,346 Prindpal retirement 82,598 61,351 72,842 60,908 Interest Bond issuance costs 421 833 3,272 3,041 289 500 491 2,073 Capital outlay Total expenditures 142,706 95821 210.430 192232 155267 93.934 45877 32.697 35.194 99.506 1,426,208 1,682,580 1,654,186 1,553,686 1,608,747 1,626,733 1,589,109 1,710,874 1,771,921 1,889,808 Excess (detciency) of revenues over (under) expenditures (68,852) (210,783) (3 16,2 58) (116,211) (91,011) (87,408) 29,4 14 46,378 78,402 64,469 ČITYAND COUNTY OF DENVER, COLORA DO Sales Tax by Category Last 10 Calendar Years (dollarsin thousands) 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Apparel stores General merchandise $ 16,4 74 $ 17,691 $ 16,241 $ 18,356 $ 20,237 $ 21, 796 $ 22,778 $ 24,111 $ 25,523 $ 26,029 17,161 16,825 16,209 16,95 3 14,699 16,921 17,704 18,276 18,527 22,189 Food stores 16,210 17,96 1 17,795 18,790 19,467 20,269 21,399 23,698 24,994 27,972 64,798 19,105 Eating and drinking establishments 60,097 67,87 8 68,520 20,413 75,531 21,827 77,886 85,211 94,4 39 101,242 106,903 21,543 35,826 38,350 22,46 1 22,584 24,410 26,138 52,708 Home furnishings, electronics and appliances 28,026 38,112 Building materials and farm tools Auto dealers and supplies 37,74 1 31,258 33,927 30,962 33,700 36,837 44,188 55,122 78,695 39,58 4 35,853 41,544 44,371 50,021 55,4 14 62,000 62,801 Service statons 11,942 24,503 34,033 10,719 14,792 20,345 16,798 15, 100 1.4,396 15,027 15,058 13,333 30,145 34,94 7 26,118 29,666 28,783 31,526 30,333 35,073 28, 164 36,415 30,944 32931 46,8 70 31,106 46,166 Public utilities 30,285 Manufadurng 40,651 38,616 Information producers and distibutors Marijuana stores - retal 36,164 41,43 1 36,154 37,531 40,445 38,576 37,877 38,213 37,036 40,450 na n/a n/a n/a 10,761 15,636 6,996 55,530 n/a 20,611 7,730 45,338 va rva 40,91 3 89,713 $468,137 $421,838 va 29,743 nva 34,631 nva va 6,451 Marijuana stores - not induding retail Other reta il stores nva 44,383 99,702 51,512 83,824 $481,023 $494,495 47,463 52,656 55,634 All other outlets 87,542 84,440 81,780 97,113 107,636 117,289 117,852 $455,436 $447,071 $53 9,348 $608,307 $640,251 $676,916 Total aty direct sales tax rate 3.50% 3.62% 3.62% 3.62% 3.62 % 3.62% 3.62% 3.62% 3.62% 3.65%