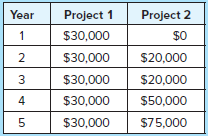

Question: Sunset Graphics is considering two mutually exclusive projects. Both require an initial investment of $100,000. Assume a marginal interest rate of 10 percent and no

a. Compute the NPV, payback, and IRR for both projects. Which is more desirable?

b. Assume straight-line depreciation is used for both projects; compute the accounting rate of return. What do you think of the ARR criterion?

c. Assume a change in interest rate to 15 percent. Does that change your views on which project the company should adopt?

d. Assume a change in interest rate to 6 percent. Does that change your views on which project the company should adopt?

e. For investments in technology, which cash inflow projection is most likely?

Project 1 Year Project 2 1 $30,000 $0 2 $30,000 $20,000 $20,000 $30,000 4 $30,000 $50,000 $30,000 $75,000 3.

Step by Step Solution

3.37 Rating (172 Votes )

There are 3 Steps involved in it

Initial investment 100000 Discount rate 10 Project Information Year Project 1 Project 2 Initial 1000... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1598_6062c74d33b48_666205.pdf

180 KBs PDF File

1598_6062c74d33b48_666205.docx

120 KBs Word File