The owner of Fine Cuisine (a business that publishes 'kitchen-tested' recipes) has come to your bank for

Question:

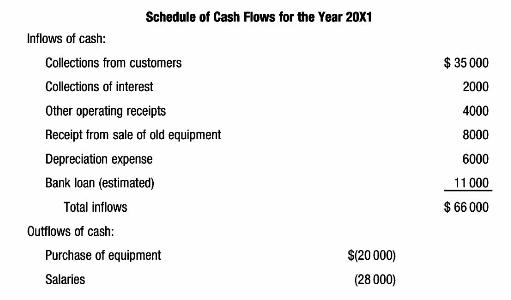

The owner of Fine Cuisine (a business that publishes 'kitchen-tested' recipes) has come to your bank for a loan. He states, 'In each of the last two years our cash has gone down. This year we need to increase our cash by \(\$ 8000\) so that we have a \(\$ 20000\) cash balance at year-end. We have never borrowed any money on a long-term basis and are reluctant to do so. However, we definitely need to purchase some new, more advanced equipment to replace the old equipment we are selling this year. We also want to invest in the share market. Given our expected net income and the money we will receive from our depreciation expense, I estimate we will have to borrow \(\$ 11000\), based on the following schedule.'

The owner explains that the business will purchase \(\$ 5000\) of kitchen furniture from him. The payment of \(\$ 5000\) from the business to him for the kitchen equipment was not included in the schedule of cash flows because it would involve only a transaction between the business and him and would be of no interest to 'outsiders'. The owner also states that if his figures are 'off a little bit', the most the business wants to borrow is \(\$ 16000\). You determine that the amounts he has listed for each item are correct, except the bank loan.

Required:

a Prepare a projected cash flow statement (using the direct method for operating cash flows) that shows the necessary bank loan for Fine Cuisine to increase cash by \(\$ 8000\).

b Explain to the owner why his \(\$ 11000\) estimate of the bank loan is incorrect.

c Suggest ways to reduce the necessary bank loan and still increase cash.

d Make a list of questions you would like the owner to answer before you decide whether or not to make a loan to Fine Cuisine.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons