The program computes federal withholding tax for each employee by multiplying gross pay times a tax rate

Question:

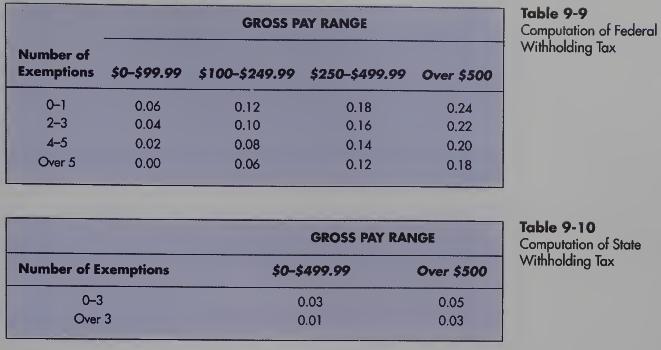

The program computes federal withholding tax for each employee by multiplying gross pay times a tax rate determined from Table 9-9. The program next computes state withholding tax for each employee by multiplying gross pay times a tax rate determined from Table 9-10.

The program next computes the employee’s pension contribution, which is 3% of gross pay for hourly employees and 4% of gross pay for salaried employees. Finally, the program computes the employee’s net pay, which is gross pay minus tax withholdings and pension contribution. Once these calculations have been completed for one employee record, the program prints that employee’s paycheck and summary earnings statement and then proceeds to the next employee input record to perform edit checks and payroll calculations, continuing this cycle until all input records have been processed.

Your short-term goal is to prepare a set of test transactions containing one of each possible type of error and another set of test transactions that will test each of the computational alternatives one at a time. Transactions to test for multiple errors in one record, or to test for multiple combinations of logic paths, are to be developed later.

The test transactions you prepare need not include a Social Security number or an employee name and address.

Required

a. Prepare a set of test transactions; each transaction should contain one of the errors tested for by the edit checks. Determine the expected results of processing for each of these test transactions.

b. Prepare a set of test transactions that tests every possible way gross pay may be calculated. Determine the expected gross pay for each of these transactions.

c. Prepare a set of test transactions that tests every possible way federal with¬ holding tax may be computed. Determine the expected value of the federal withholding tax for each of these test transactions.

d. Prepare a set of test transactions that tests every possible way state withholding tax may be computed. Determine the expected value of the state withholding tax for each of these test transactions.

e. Prepare a set of test transactions that tests every possible way the pension contribution may be computed. Determine the expected value of the pension contribution for each of these test transactions.

Step by Step Answer:

Accounting Information Systems

ISBN: 978-0136015185

11th Edition

Authors: Marshall RomneyPaul Steinbart