You are an internal auditor for the Military Industrial Company. You are presently preparing test transactions for

Question:

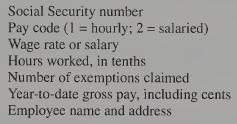

You are an internal auditor for the Military Industrial Company. You are presently preparing test transactions for the company’s weekly payroll processing pro¬ gram. Each input record to this program contains the following data items:

The program performs the following edit checks on each input • Field checks to identify any records that have nonnumeric characters in the fields for wage rate/salary, hours, exemptions, and year-to-date gross pay • A validity check of the pay code • A limit check to identify any hourly employee records with a wage rate higher than \($40\) • A limit check to identify any hourly employee records with hours worked greater than 70 hours • A limit check to identify any salaried employee records with a weekly salary greater than \($4,000\) or less than \($100\) Records that do not pass these edit checks are listed on an error report. For those that pass the edit checks, the program performs a series of calculations. First, the employee’s gross pay is determined. Gross pay for a salaried employee is equal to the salary amount contained in the wage rate field. Gross pay for an hourly employee is equal to the wage rate times the number of hours up to 40, plus

Step by Step Answer: