The Platto Company produced the following draft income statements in early January year 9, shortly before being

Question:

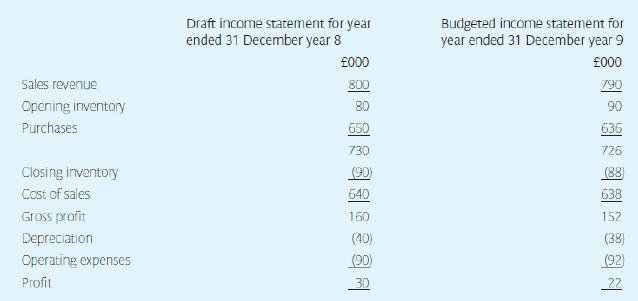

The Platto Company produced the following draft income statements in early January year 9, shortly before being taken over by the Uppit Company in February year 9.

In February year 9 the Uppit Company revised the draft accounts of the Platto Company for year 8 as follows:

a Closing inventories were written down to net realizable value, estimated at £50,000.

b Non-current assets in Chipping Sodbury were written down to an estimated fair value that led to an impairment charge of

£55,000. The net book value of the assets was reduced from

£120,000 to £65,000.

During year 9 the actual results of the Platto Company were much the same as had been budgeted, except that:

c Sales were reduced by £32,000 because inventories left from year 8, which were originally expected to be sold for £112,000, were, in fact, sold for £80,000.

d The non-current assets in Chipping Sodbury were sold for

£90,000; as a result the total depreciation charge for year 9 was reduced from a budgeted level of £38,000 to an actual level of

£26,000. The total of other operating expenses was unaffected.

Required:

i Show the summarized income statement for the Platto Company for year 8, as modified by the Uppit Company.

ii Show the summarized income statement for the Platto Company for year 9.

iii Explain and comment.

Step by Step Answer: