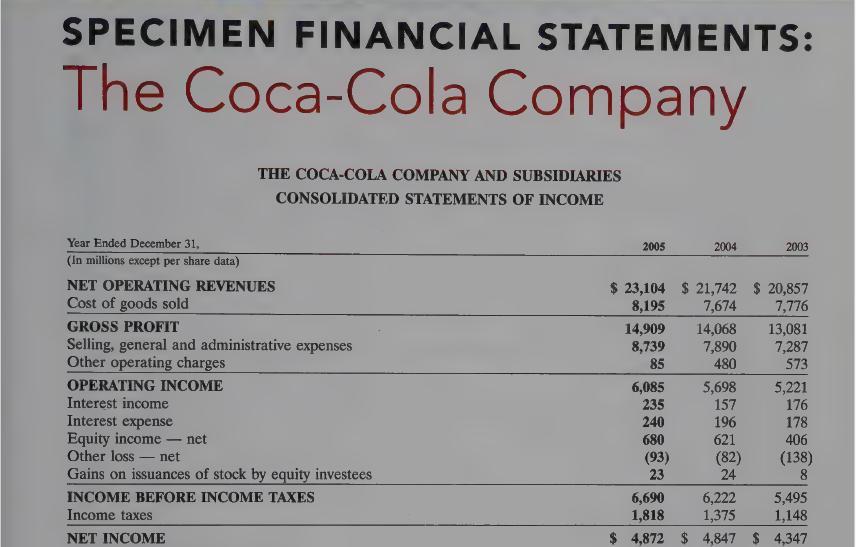

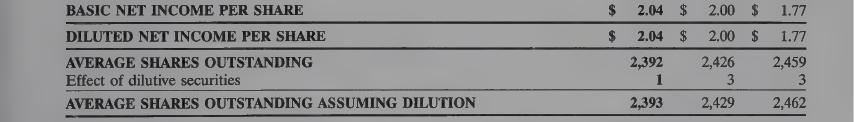

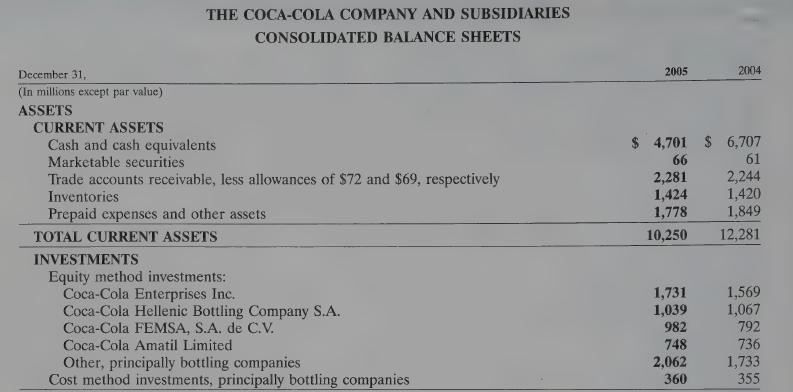

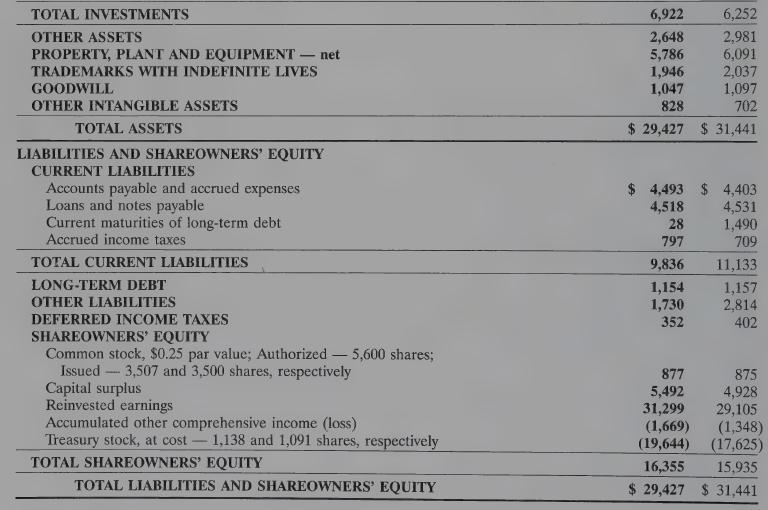

Question: Appendix A presents PepsiCos financial statements. Appendix B presents Coca-Colas financial statements. Instructions (a) Based on the information contained in these financial statements, determine each

Appendix A presents PepsiCo’s financial statements. Appendix B presents Coca-Cola’s financial statements.

Instructions

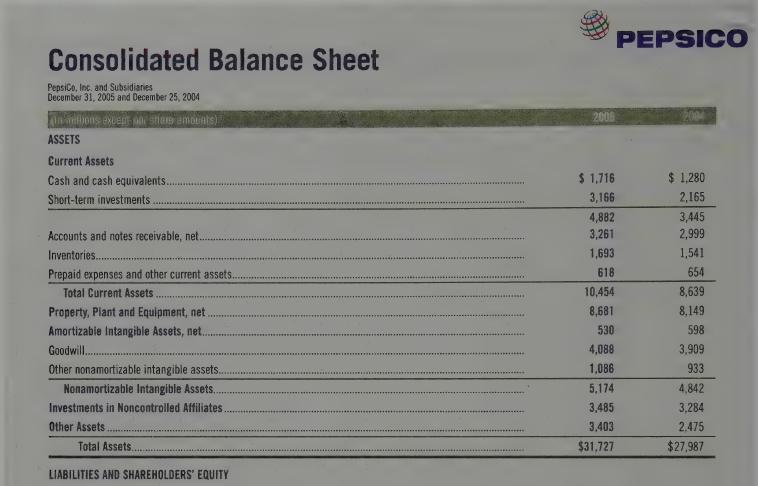

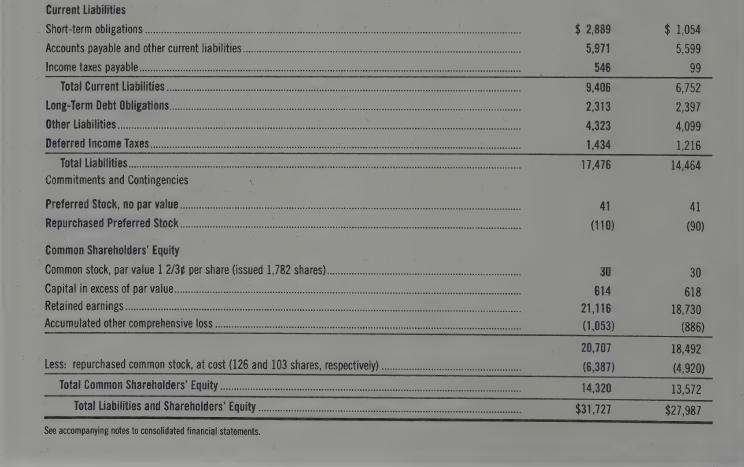

(a) Based on the information contained in these financial statements, determine each of the following for PepsiCo at December 31, 2005, and for Coca-Cola at December 31, 2005.

(1) Total current assets.

(2) Net amount of property, plant, and equipment (land, buildings, and equipment).

(3) Total current liabilities.

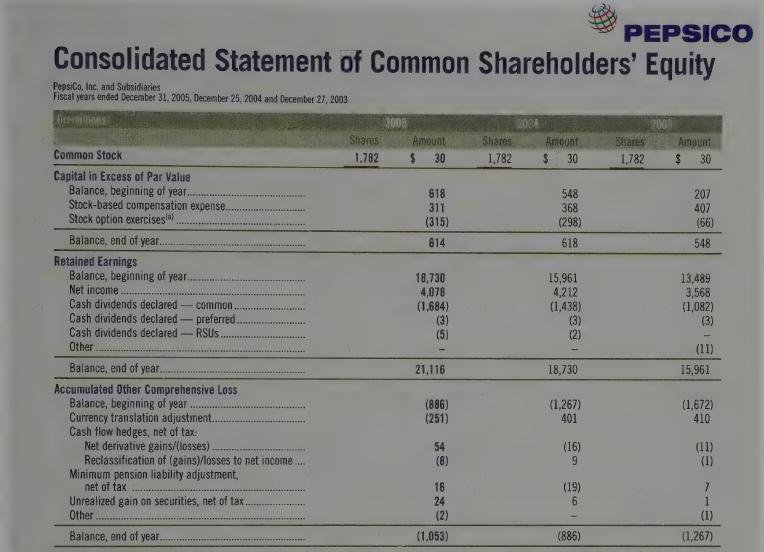

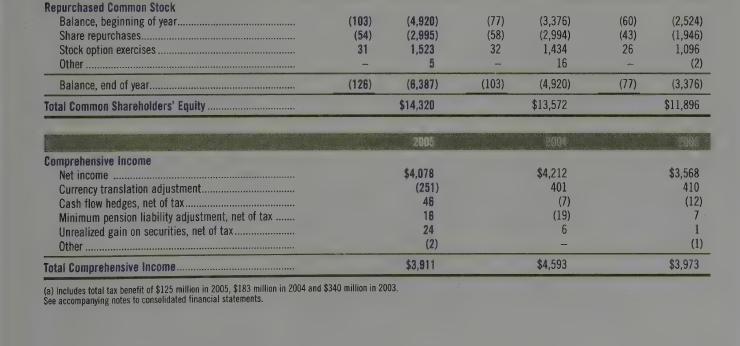

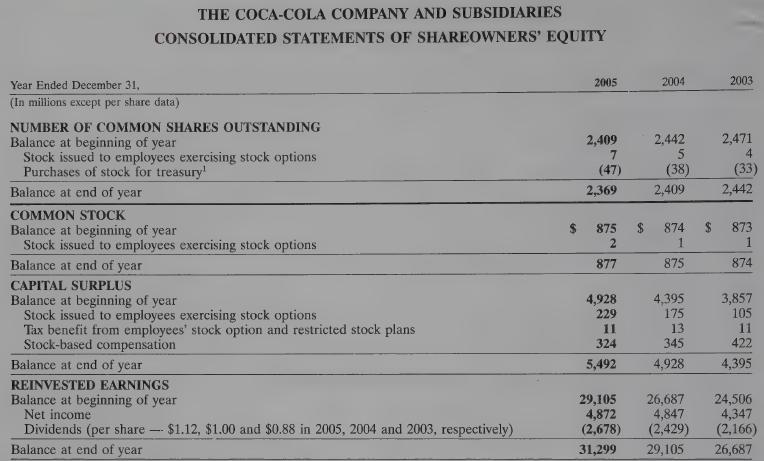

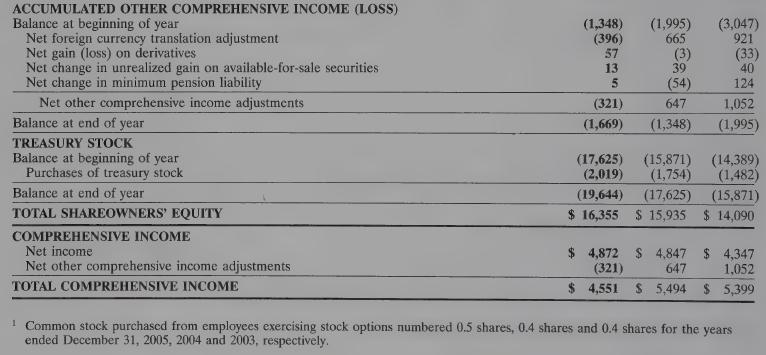

(4) Total stockholders’ (shareholders’) equity.

(b) What conclusions concerning the companies’ respective financial positions can be drawn?

Data from Appendix A

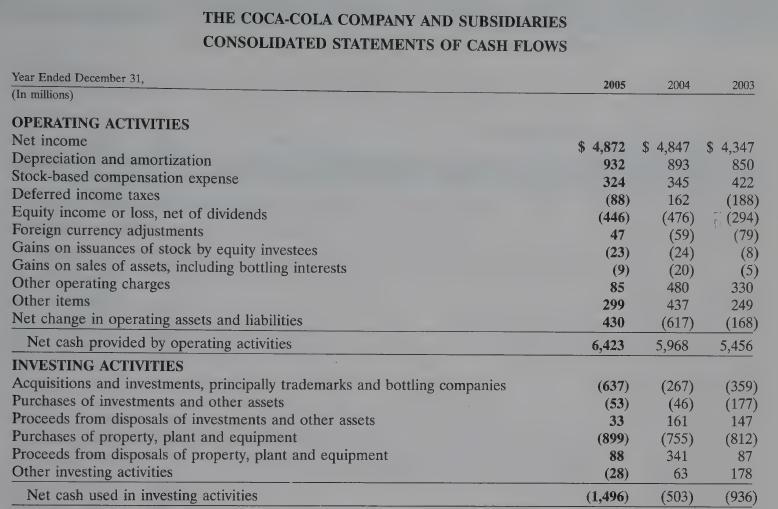

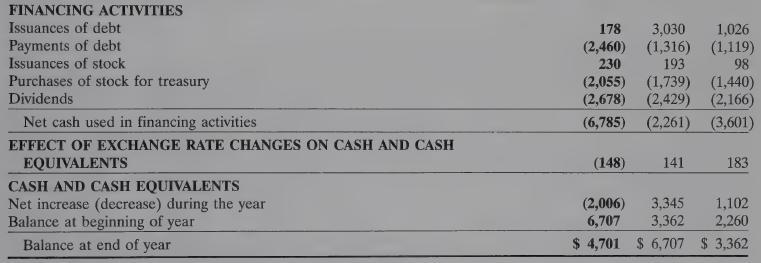

Data from Appendix B

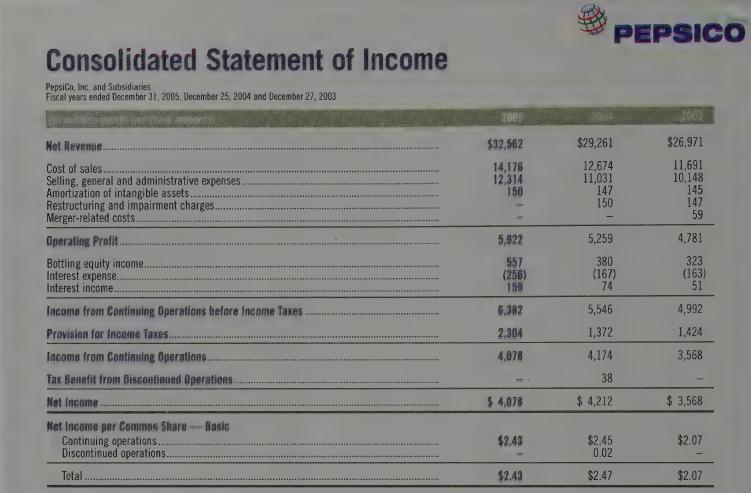

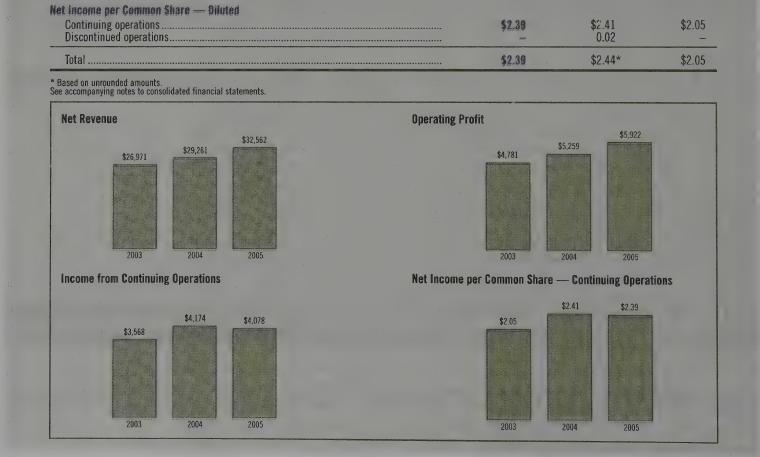

Consolidated Statement of Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 31, 2005, December 25, 2004 and December 27, 2003 PEPSICO 2003 Het Revenue......... Cost of sales. Selling, general and administrative expenses. $32,562 $29,261 $26,971 14,176 12,674 11,691 12.314 11,031 10,148 Amortization of intangible assets. 150 147 145 Restructuring and impairment charges.. 150 147 Merger-related costs... 59 Operating Profit. 5.922 5,259 4,781 Bottling equity income.. 557 380 323 Interest expense... (256) (167) (163) Interest income... 159 74 51 Income from Continuing Operations before Income Taxes. 6.382 5,546 4,992 Provision for Income Taxes......... 2,304 1,372 1,424 Income from Continuing Operations... 4,078 4,174 3,568 Tax Benefit from Discontinued Operations. 38 Net Income Net Income per Common Share Continuing operations.. Discontinued operations.. Total $4,078 $ 4,212 $ 3,568 Basic $2.43 $2.45 $2.07 0.02 $2.43 $2.47 $2.07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts