Presented below are three different lease transactions that occurred for Klippert Inc., a public company. Assume that

Question:

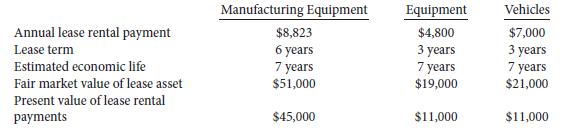

Presented below are three different lease transactions that occurred for Klippert Inc., a public company. Assume that all lease contracts start on January 1, 2014. Klippert does not receive title to any of the properties, either during the lease term or at the end of it. Annual lease payments are made on January 1 of each year starting on January 1, 2014.

Instructions

(a) Which of the leases above are operating leases and which are finance leases? Explain.

(b) How should the lease transaction for each of the above assets be recorded on January 1, 2014?

(c) Describe how the lease transaction would be reported on the income statement and balance sheet for each of the above assets for 2014.

TAKING IT FURTHER For each of the leases, prepare any required adjusting journal entries on December 31, 2014. Assume that Klippert Inc. would pay 7% interest if it borrowed cash and purchased the equipment instead of leasing the equipment.

Step by Step Answer:

Accounting Principles Part 3

ISBN: 978-1118306802

6th Canadian edition Volume 1

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Kinnear, Joan E. Barlow