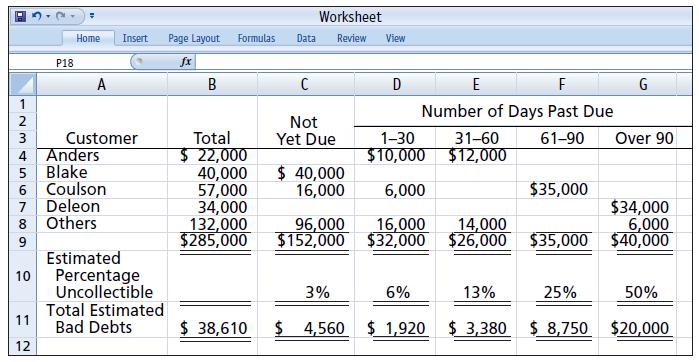

Presented below is an aging schedule for Halleran Company. At December 31, 2020, the unadjusted balance in

Question:

Presented below is an aging schedule for Halleran Company.

At December 31, 2020, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,000.

Instructions

a. Journalize and post the adjusting entry for bad debts at December 31, 2020.

b. Journalize and post to the allowance account the following events and transactions in the year 2021.

1. On March 31, a $1,000 customer balance originating in 2020 is judged uncollectible.

2. On May 31, a check for $1,000 is received from the customer whose account was written off as uncollectible on March 31.

c. Journalize the adjusting entry for bad debts on December 31, 2021, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $800 and the aging schedule indicates that total estimated bad debts will be $31,600.

Step by Step Answer:

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso