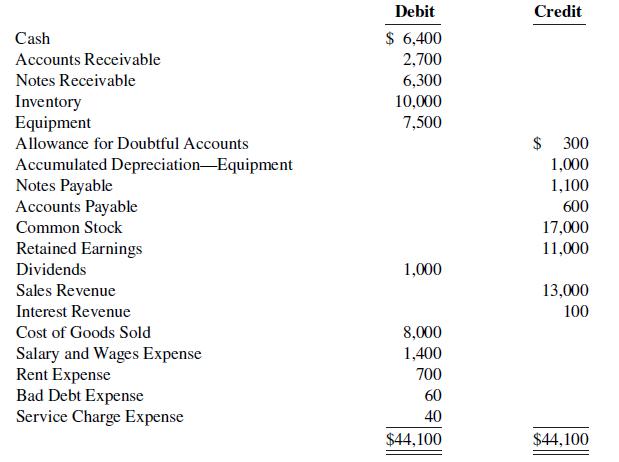

The adjusted trial balance of Gibson Company for the year ended December 31, 2020, is as follows:

Question:

The adjusted trial balance of Gibson Company for the year ended December 31, 2020, is as follows:

Instructions

Prepare a multiple-step income statement, retained earnings statement, and a classified balance sheet. The notes payable is due on January 10, 2021.

Debit Credit Cash $ 6,400 Accounts Receivable 2,700 Notes Receivable 6,300 Inventory Equipment 10,000 7,500 Allowance for Doubtful Accounts $ 300 Accumulated Depreciation-Equipment Notes Payable Accounts Payable 1,000 1,100 600 Common Stock 17,000 Retained Earnings 11,000 Dividends 1,000 Sales Revenue 13,000 Interest Revenue 100 Cost of Goods Sold 8,000 1,400 Salary and Wages Expense Rent Expense Bad Debt Expense Service Charge Expense 700 60 40 $44,100 $44,100

Step by Step Answer:

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

On December 31, the adjusted trial balance of Oslo Employment Agency shows the following selected data. Analysis shows that adjusting entries were made to (1) accrue $4,500 of commission revenue and...

-

The adjusted trial balance of Bradley Irrigation System at December 31, 2018, follows: Requirements 1. Prepare the company's income statement for the year ended December 31, 2018. 2. Prepare the...

-

On December 31, the adjusted trial balance of Johnson Employment Agency shows the following selected data. Accounts Receivable $24,500 Service Revenue $92,500 Interest Expense 8,300 Interest Payable...

-

The accompanying data were read from graphs that appeared in the article Bush Timber Proposal Runs Counter to the Record (San Luis Obispo Tribune, September 22, 2002). The variables shown are the...

-

The boiling points, surface tensions, and viscosities of water and several alchohols are as follows: (a) For ethanol, propanol, and n-butanol the boiling points, surface tensions, and viscosities all...

-

Santana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term bank loan. Selected account balances at March 31, 2022, for Business...

-

Use the wine quality data in Table B. 11 to construct a regression model for quality using the stepwise regression approach. Compare this model to the one you found in Problem 10.4, part a. Data From...

-

Jose Pena and Joseph Antenucci were medical doctors who were partners in a medical practice. Both doctors treated Elaine Zuckerman during her pregnancy. Her son, Daniel Zuckerman, was born with...

-

Suppose the real risk - free rate is 3 . 5 0 % , the average future inflation rate is 2 . 5 0 % , a maturity premium of 0 . 2 0 % per year to maturity applies, i . e . , MRP = 0 . 2 0 % ( t ) , where...

-

Turner Woodworking, LLC is a small family owned manufacturing business. They have three primary products: Birdhouse Porch swing Freestanding hammock All products are made within their existing...

-

Presented below is an aging schedule for Halleran Company. At December 31, 2020, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,000. Instructions a. Journalize and post...

-

Winter Companys balance sheet at December 31, 2019, is presented below. During January 2020, the following transactions occurred. Winter uses the perpetual inventory method. Jan. 1 Winter accepted a...

-

Following is partial information for the income statement of Arturo Technologies Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1....

-

Variable costs change with _____.

-

A products utility to a buyer is measured by ______. a) its usefulness b) its price c) how much the buyer is willing to pay for it d) none of the above

-

When demand rises and supply stays the same, ______. a) equilibrium quantity rises b) equilibrium quantity declines c) equilibrium quantity stays the same.

-

If a service is free, you will consume more and more of it until ______. a) your marginal utility is zero b) your total utility is zero c) both your marginal utility and your total utility are zero...

-

Determining and evaluating project cash flows for a home solar system You are keen on the use of solar power and have decided to evaluate investing in a solar system for your home. After consulting...

-

On January 1, 2016, Uncle Company purchased 80 percent of Nephew Company's capital stock for $500,000 in cash and other assets. Nephew had a book value of $600,000, and the 20 percent noncontrolling...

-

Frontland Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Frontland had to replace an inexperienced office worker in charge of bookkeeping because of...

-

Three years ago Sue Gilligan and her brother-in-law Dan Laurent opened Mallmart Department Store. For the first 2 years, business was good, but the following condensed income statement results for...

-

Angie Oaks was just hired as the assistant treasurer of Yorkshire Stores, a specialty chain store company that has nine retail stores concentrated in one metropolitan area. Among other things, the...

-

There are many situations in business where it is difficult to determine the proper period in which to record revenue. Suppose that after graduation with a degree in finance, you take a job as a...

-

Discuss with examples about financial innovation& how it develops banking industry?

-

Elaborate with real world examples about different financial markets that contributed towards growth of financial sector?

-

The following statement of financial position is for the partnership of Able, Brown, and Crown at November 1, 2018. Assets Liabilities Cash $ 20,000 Accounts payable $ 50,000 Other assets 180,000...

Study smarter with the SolutionInn App