Loblaw Companies Limited is Canadas food and pharmacy leader and the nations largest retailer. The company operates

Question:

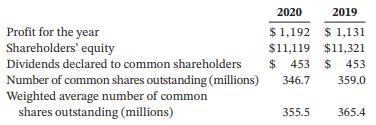

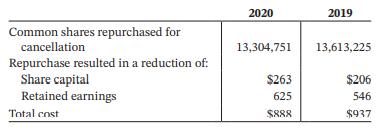

Loblaw Companies Limited is Canada’s food and pharmacy leader and the nation’s largest retailer. The company operates stores such as Real Canadian Superstore and Shoppers Drug Mart in communities across Canada. In 2020, Loblaw renewed its application to repurchase up to 17.9 million more common shares after 13.3 million and 13.6 million were repurchased and cancelled in 2020 and 2019, respectively. Financial information for Loblaw for the years ended January 2, 2021, and December 28, 2019 (in millions of dollars except per share data) follows:

Instructions

a. Explain the different effects that a cash dividend, stock dividend, and stock split would have on Loblaw’s assets, liabilities, shareholders’ equity, and the number of shares outstanding.

b. What is the likely reason that Loblaw has repurchased its common shares?

c. During the fiscal periods ended January 2, 2021, and December 28, 2019, Loblaw repurchased and cancelled a total of 26,917,976 common shares. The weighted average market share price in fiscal 2020, 2019, and 2018 was $68.22, $69.21, and $65.45, respectively. Common dividends declared in fiscal 2020, 2019, and 2018 were $1.28, $1.24, and $1.155, respectively. Comment on the impact the reacquisition may have had on the market price and dividends per share.

d. Based on the following information from the notes to the financial statements of Loblaw (in millions of dollars except common share data) for the year ended January 2, 2021, on the share reacquisition, did the company pay more than the average per share amount or less than the average per share amount to repurchase the common shares in 2020 and 2019? Explain.

e. Calculate the return on shareholders’ equity, earnings per share, and payout ratio for the shareholders for the fiscal periods 2020 and 2019. Comment on the company’s profitability. Shareholders’ equity at December 29, 2019, was $12,178.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak