On December 31, 2023, Asaad Corporation, a public company, had the following shareholders equity accounts: During 2024,

Question:

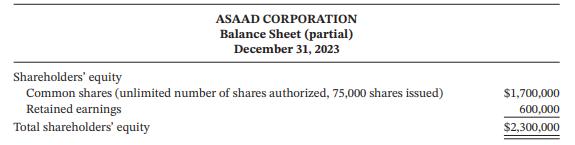

On December 31, 2023, Asaad Corporation, a public company, had the following shareholders’ equity accounts:

During 2024, the following transactions occurred:

Feb. 1 Declared a $1 cash dividend to shareholders of record on February 15 and payable on March 1.

Apr. 1 Announced a 2-for-1 stock split. The market price per share was $36 on the date of the announcement.

Dec. 1 Declared a 5% stock dividend to shareholders of record on December 20, distributable on January 5. On December 1, the shares’ market price was $16 per share; on December 20, it was $18 per share; and on January 5, it was $15 per share.

31 Determined that profit before income tax for the year was $400,000. The company has a 25% income tax rate.

Instructions

a. Journalize the transactions and closing entries for 2024.

b. Create general ledger accounts and enter the beginning balances from the December 31, 2023, partial balance sheet. Post the entries in part (a) to the shareholders’ equity accounts. (Note: Open additional shareholders’ equity accounts as needed.)

c. Prepare the shareholders’ equity section of the balance sheet at December 31, 2024.

Stock splits and stock dividends do not change the company’s total assets. Given that, why does the share price change after a stock split or stock dividend?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak