Question: Presented below are the comparative balance sheets and income statement for Wayfarer Inc., a private company reporting under ASPE. Additional information: 1. Cash dividends of

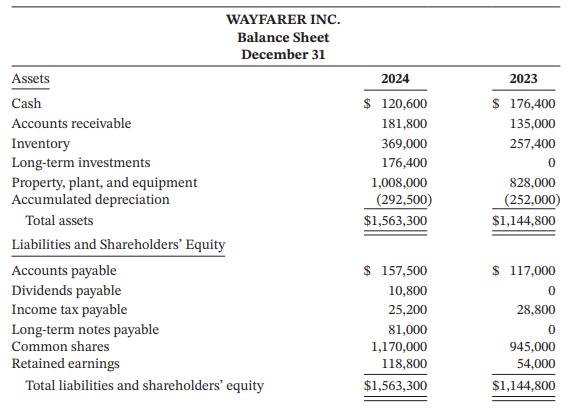

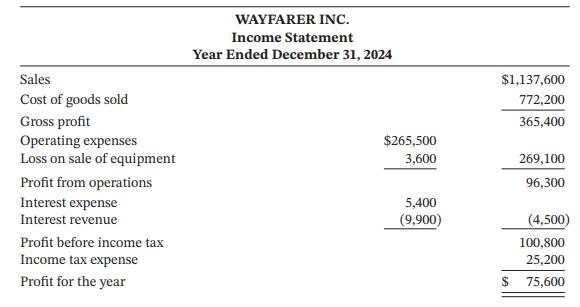

Presented below are the comparative balance sheets and income statement for Wayfarer Inc., a private company reporting under ASPE.

Additional information:

1. Cash dividends of $10,800 were declared on December 30, 2024, payable on January 15, 2025.

2. A long-term investment was acquired for cash at a cost of $176,400.

3. Depreciation expense is included in the operating expenses.

4. The company issued 22,500 common shares on March 2, 2024 in exchange for additional equipment. The fair value of the shares was $10 per share.

5. Equipment that originally cost $45,000 was sold during the year for cash. The equipment had a carrying amount of $16,200 at the time of sale.

6. The company issued a note payable for $90,000 and repaid $9,000 of it by year end.

7. Accounts payable is used for merchandise purchases.

8. Accounts receivable relate to merchandise sales.

Instructions

a. Prepare a cash flow statement for the year using the indirect method.

b. Prepare the operating section of the cash flow statement using the direct method.

Wayfarer Inc.’s cash balance decreased by $55,800 in 2024. Briefly explain what caused this, using the cash flow statement. Should management be concerned about this decrease? Explain.

WAYFARER INC. Balance Sheet December 31 Assets Cash Accounts receivable Inventory Long-term investments Property, plant, and equipment Accumulated depreciation Total assets Liabilities and Shareholders' Equity Accounts payable Dividends payable Income tax payable Long-term notes payable Common shares Retained earnings Total liabilities and shareholders' equity 2024 $ 120,600 181,800 369,000 176,400 1,008,000 (292,500) $1,563,300 $ 157,500 10,800 25,200 81,000 1,170,000 118,800 $1,563,300 2023 $ 176,400 135,000 257,400 0 828,000 (252,000) $1,144,800 $ 117,000 0 28,800 0 945,000 54,000 $1,144,800

Step by Step Solution

3.51 Rating (181 Votes )

There are 3 Steps involved in it

a Note Common shares were issued to purchase equipment costing 225000 Calculations 1 2 b Calculation... View full answer

Get step-by-step solutions from verified subject matter experts