Question: Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: Required: a. Calculate return on investment, based on net income

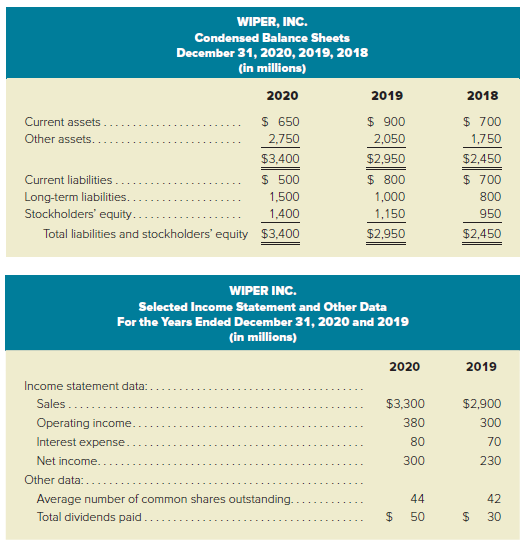

Presented here are summarized data from the balance sheets and income statements of Wiper Inc.:

Required:

a. Calculate return on investment, based on net income and average total assets, for 2020 and 2019. Show both margin and turnover in your calculation.

b. Calculate return on equity for 2020 and 2019.

c. Calculate working capital and the current ratio for each of the past three years.

d. Calculate earnings per share for 2020 and 2019.

e. If Wiper?s stock had a price/earnings ratio of 14 at the end of 2020, what was the market price of the stock?

f. Calculate the cash dividend per share for 2020 and the dividend yield based on the market price calculated in part e.

g. Calculate the dividend payout ratio for 2020.

h. Assume that accounts receivable at December 31, 2020, totaled $310 million. Calculate the number of days? sales in receivables at that date.

i. Calculate Wiper?s debt ratio and debt/equity ratio at December 31, 2020 and 2019.

j. Calculate the times interest earned ratio for 2020 and 2019.

k. Review the results of these calculations, evaluate the profitability and liquidity of this company, and state your opinion about its suitability as an investment for a young, single professional with funds to invest in common stock.

WIPER, INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2018 2020 2019 $ 700 $ 650 $ 900 Current assets 1,750 Other assets. 2,750 2,050 $2,450 $3,400 $2,950 $ 700 $ 500 1,500 $ 800 Current liabilities Long-term liabilities. Stockholders' equity.. 1,000 800 1,400 1,150 950 Total liabilities and stockholders' equity $3,400 $2,950 $2,450 WIPER INC. Selected Income Statement and Other Data For the Years Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: . $2,900 Sales.... $3,300 Operating income. 380 300 Interest expense. 80 70 Net income. 300 230 Other data:. Average number of common shares outstanding. 44 42 Total dividends paid 50 30 24 %24

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

a 2020 ROI 300 3300 3300 2950 3400 2 91margin 104turnover 94 2019 ROI 230 2900 2900 2450 2950 2 79 margin 107 turnover 85 b ROE Net income Average sto... View full answer

Get step-by-step solutions from verified subject matter experts