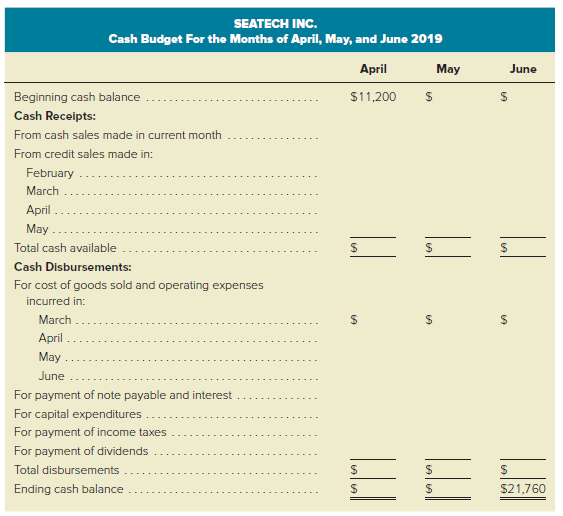

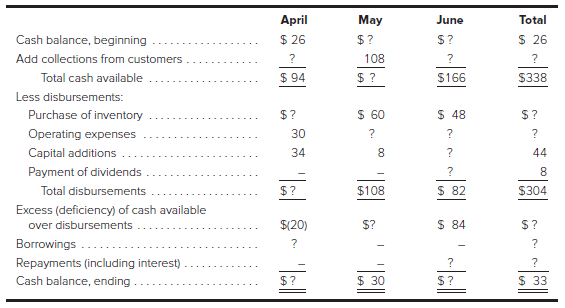

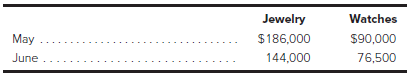

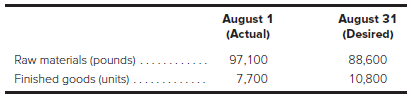

Accounting What the Numbers Mean 12th edition David Marshall, Wayne McManus, Daniel Viele - Solutions

Unlock the full potential of "Accounting: What the Numbers Mean" 12th edition by David Marshall, Wayne McManus, and Daniel Viele with our comprehensive solutions. Access online answers key and solutions PDF, providing step-by-step answers to all solved problems. Our solution manual and instructor manual ensure a deeper understanding of textbook concepts. Enhance your learning with questions and answers from our test bank, complete with detailed chapter solutions. Whether you're seeking free download options or expert guidance, our resources offer the ultimate support for mastering accounting principles.

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()