Moyle Co. acquired a machine on January 1, 2022, at a cost of $1,500,000. The machine is

Question:

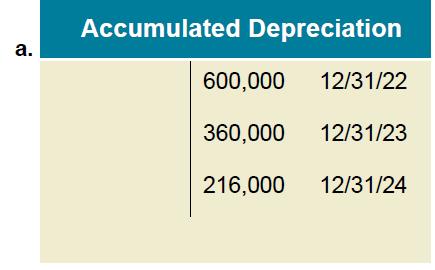

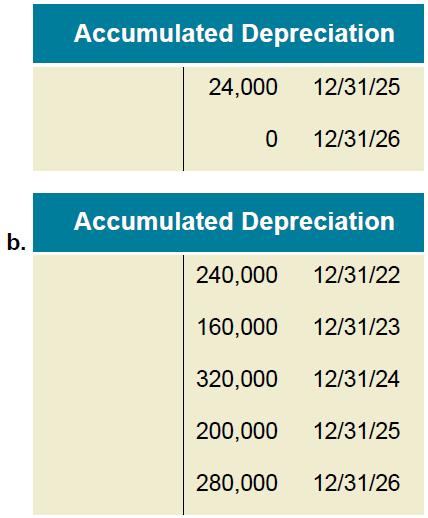

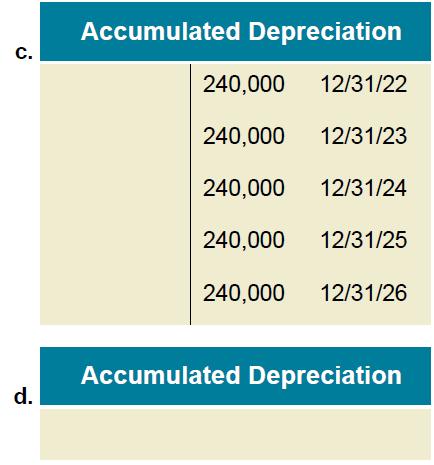

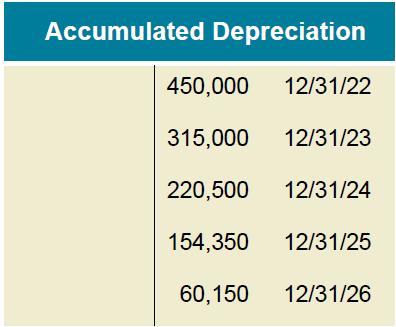

Moyle Co. acquired a machine on January 1, 2022, at a cost of $1,500,000. The machine is expected to have a five-year useful life, with a salvage value of $300,000. The machine is capable of producing 1,500,000 units of product in its lifetime. Actual production was as follows: 300,000 units in 2022; 200,000 units in 2023; 400,000 units in 2024; 250,000 units in 2025; and 350,000 units in 2026. Items a through d below are T-account representations of Moyle Co.’s accumulated depreciation account. They reflect the depreciation adjustments that would be made each year for the above described machine using various depreciation calculation methods.

Required:

Identify the depreciation method that would result in each of these annual credit amount patterns to accumulated depreciation. If a declining-balance method is used, indicate the percentage (150% or 200%).

Step by Step Answer: