1. In partnership liquidation the final cash distribution to the partners should be made in accordance with...

Question:

1. In partnership liquidation the final cash distribution to the partners should be made in accordance with the:

a Partner profit- and loss-sharing ratios

b Balances of partner capital accounts

c Ratio of the capital contributions by partners

d Safe payments computations

2. In accounting for the liquidation of a partnership, cash payments to partners after all nonpartner creditors’ claims have been satisfied, but before final cash distribution, should be according to:

a Relative profit- and loss-sharing ratios

b The final balances in partner capital accounts

c The relative share of gain or loss on liquidation

d Safe payments computations

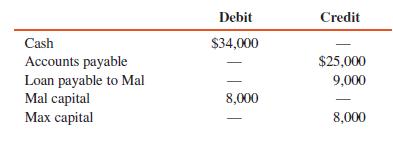

3. After all noncash assets have been converted into cash in the liquidation of the Mal and Max partnership, the ledger contains the following account balances:

Available cash should be distributed as follows: $25,000 to accounts payable and:

a $9,000 for loan payable to Mal

b $4,500 each to Mal and Max

c $1,000 to Mal and $8,000 to Max

d $8,000 to Mal and $1,000 to Max

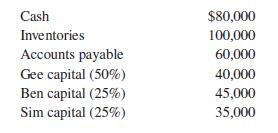

4. The partnership of Gee, Ben, and Sim is liquidating and the ledger shows the following:

If all available cash is distributed immediately:

a Gee, Ben, and Sim should get $26,667 each

b Gee, Ben, and Sim should get $6,667 each

c Gee should get $10,000, and Ben and Sim should get $5,000 each

d Ben should get $15,000, and Sim $5,000

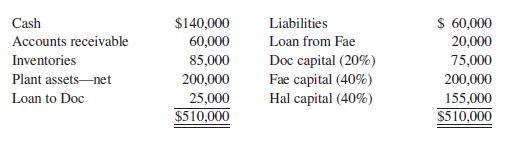

5. The following balance sheet summary, together with residual profit-sharing ratios, was developed on April 1, 2016, when the Doc, Fae, and Hal partnership began its liquidation:

If available cash except for a $5,000 contingency fund is distributed immediately, Doc, Fae, and Hal, respectively, should receive:

a $0, $60,000, and $15,000

b $11,000, $22,000, and $22,000

c $0, $70,000, and $5,000

d $0, $27,500, and $27,500

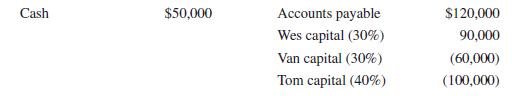

6. The partnership of Wes, Van, and Tom was dissolved on June 30, 2016, and account balances after noncash assets were converted into cash on September 1, 2016, are:

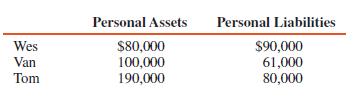

Personal assets and liabilities of the partners at September 1, 2016, are:

If Tom contributes $70,000 to the partnership to provide cash to pay the creditors, what amount of Wes’s $90,000 partnership equity would appear to be recoverable?

a $90,000

b $81,000

c $79,000

d None of the above

Step by Step Answer:

Advanced Accounting

ISBN: 978-0134472140

13th edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith