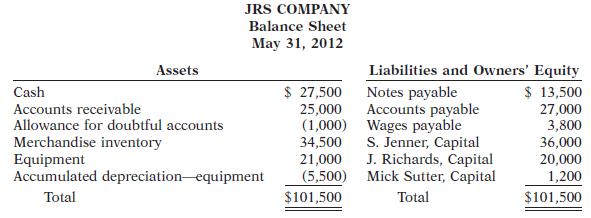

The partners in JRS Company decide to liquidate the firm when the balance sheet shows the following.

Question:

The partners in JRS Company decide to liquidate the firm when the balance sheet shows the following.

The partners share income and loss 5 :3 :2. During the process of liquidation, the following transactions were completed in the following sequence.

1. A total of $53,000 was received from converting noncash assets into cash.

2. Gain or loss on realization was allocated to partners.

3. Liabilities were paid in full.

4. Mick Sutter paid his capital deficiency.

5. Cash was paid to the partners with credit balances.

Instructions

(a) Prepare the entries to record the transactions.

(b) Post to the cash and capital accounts.

(c) Assume that Sutter is unable to pay the capital deficiency.

(1) Prepare the entry to allocate Sutter’s debit balance to Jenner and Richards.

(2) Prepare the entry to record the final distribution of cash.

Step by Step Answer:

Accounting Tools for business decision making

ISBN: 978-0470095461

4th Edition

Authors: kimmel, weygandt, kieso