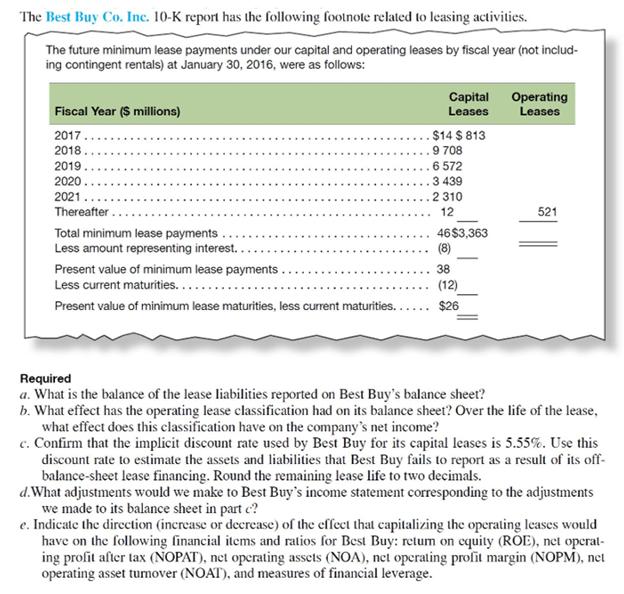

Question: The Best Buy Co. Inc. 10-K report has the following footnote related to leasing activities. The future minimum lease payments under our capital and

The Best Buy Co. Inc. 10-K report has the following footnote related to leasing activities. The future minimum lease payments under our capital and operating leases by fiscal year (not includ- ing contingent rentals) at January 30, 2016, were as follows: Capital Operating Leases Fiscal Year (S millions) Leases 2017. $14 $ 813 2018 .9 708 6 572 2019 2020 3 439 2 310 2021 Thereafter 12 521 Total minimum lease payments Less amount representing interest. 46$3,363 (8) Present value of minimum lease payments 38 Less current maturities.... (12) Present value of minimum lease maturities, less current maturities. $26 Required a. What is the balance of the lease liabilities reported on Best Buy's balance sheet? b. What effect has the operating lease classification had on its balance sheet? Over the life of the lease, what effect does this classification have on the company's net income? c. Confirm that the implicit discount rate used by Best Buy for its capital leases is 5.55%. Use this discount rate to estimate the assets and liabilities that Best Buy fails to report as a result of its off- balance-sheet lease financing. Round the remaining lease life to two decimals. d.What adjustments would we make to Best Buy's income statement corresponding to the adjustments we made to its balance sheet in part c? e. Indicate the direction (increase or decrease) of the effect that capitalizing the operating leases would have on the following financial items and ratios for Best Buy: retum on equity (ROE), net operat- ing profit after tax (NOPAT), net operating assets (NOA), nct operating profit margin (NOPM), net operating asset tumover (NOAT), and measures of financial leverage.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Leases as shown in Balance sheet Financial Lease Inception Dep PPE 38 Cash Int 633 Cash e... View full answer

Get step-by-step solutions from verified subject matter experts