A wholly owned foreign subsidiary of Nick Inc. has certain expense accounts for the year ended December

Question:

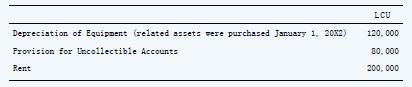

A wholly owned foreign subsidiary of Nick Inc. has certain expense accounts for the year ended December 31, 20X4, stated in local currency units (LCU) as follows:

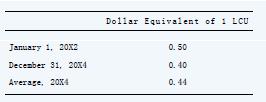

The exchange rates at various dates were as follows:

What total dollar amount should be included in Nick’s income statement to reflect the preceding expenses for the year ended December 31, 20X4?

a. $160,000

b. $168,000

c. $176,000

d. $183,200 First assume that the foreign currency is the functional currency; then assume that the U.S. dollar is the functional currency.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted: