Beryl Corporation acquired 100 percent of Stargel Enterprises' common stock on December 31, 20X4. At that date,

Question:

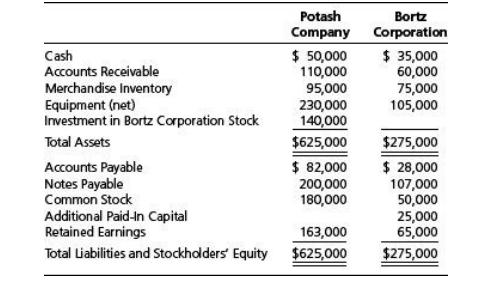

Beryl Corporation acquired 100 percent of Stargel Enterprises' common stock on December 31, 20X4. At that date, the book values and fair values of Stargel's identifiable assets and liabilities were identical. Balance sheet data for the individual companies and the consolidated entity on January 1, 20X5, are as follows:

Required

a. Assuming there were no inventory transactions between the companies, what balance for inventory should be reported in the consolidated balance sheet?

b. What amount did Beryl pay to acquire Stargel? Was this amount equal to, greater than, or less than underlying book value? How do you know?

c. Beryl sold land it had purchased 12 years earlier for $10,000 to Stargel immediately after it acquired Stargel. At what price did Beryl sell the land to Stargel? How do you know?

d. What balance will be reported as accounts payable in the consolidated balance sheet?

e. What is the par value of Beryl's common stock outstanding at January 1,20X5?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0073526911

8th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey