Billing Enterprises purchases a 90% interest in the common stock of Rush Corporation on January 1, 2015,

Question:

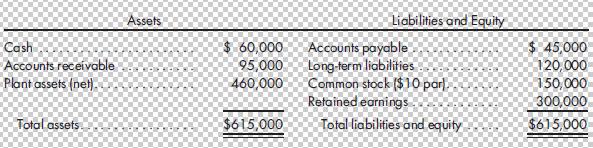

Billing Enterprises purchases a 90% interest in the common stock of Rush Corporation on January 1, 2015, for an agreed-upon price of $495,000. Billing issues $400,000 of bonds to Rush shareholders plus $95,000 cash as payment. Rush’s balance sheet on the acquisition date is as follows:

Rush’s equipment is understated by $20,000 and has a remaining depreciable life of five years. Any remaining excess is attributed to goodwill.

In addition to the bonds issued as part of the purchase, Billing sells additional bonds in the amount of $100,000.

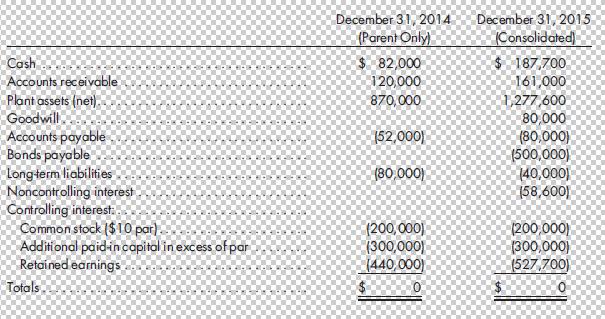

Consolidated net income for 2015 is $92,300. The controlling interest is $87,700, and the noncontrolling interest is $4,600. Rush pays $10,000 in dividends to all shareholders, including Billing Enterprises.

No plant assets are purchased or sold during 2015.

Comparative balance sheet data are as follows:

Required

Prepare a consolidated statement of cash flows using the indirect method for the year ended December 31, 2015. Supporting schedules (including aD&Dschedule) should be in good form.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng