Bishop Enterprises acquired 100 percent of Mangle Manufacturing Company's common shares on January 1, 20X7, for $1,250,000,

Question:

Bishop Enterprises acquired 100 percent of Mangle Manufacturing Company's common shares on January 1, 20X7, for $1,250,000, a price that was $55,000 in excess of the book value of the shares acquired. The excess of the $1,220,000 fair value of the net assets held by Mangle over book value was related to equipment with a five-year remaining life at the date of acquisition.

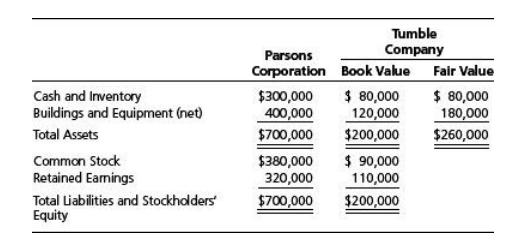

Balance sheets for the two companies as of December 31, 20X7, were as follows:

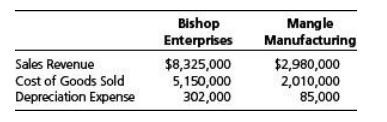

For the year 20X7, the separate income statements of Bishop and Mangle included, among other items, the following:

The only intercompany transaction during 20X7 was the sale of inventory at year-end from Bishop to Mangle. Bishop originally purchased the goods for $34,000 and sold them to Mangle for $45,000 on account. Mangle still had all of the goods in its inventory at year-end but had not yet paid for them.

Required

Indicate the amount at which Bishop and its subsidiary would report each of the following items in the 20X7 consolidated financial statements:

a. Cash.

b. Receivables (net).

c. Inventory.

d. Investment in Mangle Stock.

e. Equipment (net).

f. Goodwill.

g. Current Payables.

h. Common Stock (par).

i. Sales Revenue.

j. Cost of Goods Sold

k. Depreciation Expense

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0073526911

8th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey