Cambell Corporation had the following transactions in derivatives in 20x5: Transaction 1 Cambell Corporation bought 100,000 shares

Question:

Cambell Corporation had the following transactions in derivatives in 20x5:

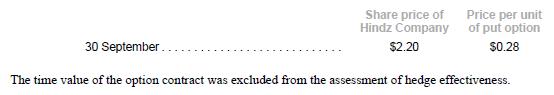

Transaction 1 Cambell Corporation bought 100,000 shares of Hindz Company on 31 July 20x5 at $2.50 per share. The long term equity investment is classified as FVOCI. At the same date, Cambell Corporation purchased an out-of-the-money put option on 100,000 shares of Hindz Company and paid a premium of $3,000. The put option had an exercise price of $2.48 and expired on 30 September 20x5. The purpose of the put option was to provide Cambell Corporation with partial protection against declines in the share price of Hindz Company. Cambell Corporation designated the change in the intrinsic value of the put as the hedging instrument and the hedge as a fair value hedge of changes in the fair value of its investment in Hindz Company. At 30 September, Cambell Corporation continued to hold the 100,000 shares in Hindz Company and the put option position was closed on a net basis. The prices of Hindz Company shares and the put option are as follows:

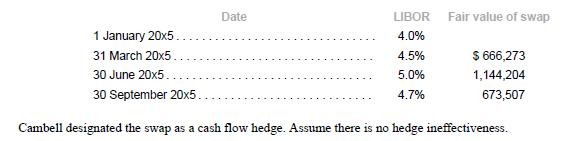

Transaction 2 On 1 January 20x5, Cambell Corporation borrowed $80,000,000 from a bank for a period of 24 months at an interest rate based on the London Interbank Offer Rate (LIBOR) plus 50 basis points. Interest on the loan was payable quarterly. Cambell entered into a swap with a financial intermediary on 1 January 20x5, which involved Cambell paying a fixed rate of 4.5% per annum and receiving LIBOR plus 50 basis points. The notional amount of the swap was $80,000,000. LIBOR rates were reset quarterly beginning with 1 January 20x5 in order to determine the next interest payment. Differences between the fixed rate and the variable rate would be settled on a quarterly basis. The following information pertains to interest rates and fair value of the swap over 20x5.

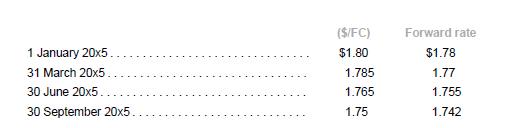

Transaction 3 On 1 January 20x3, Cambell acquired an 80% interest in the share capital of OGRE Inc, a foreign company with a paid-up capital of FC 2,000,000, and retained earnings of FC 300,000. Subsequent to the date of acquisition, the FC began to depreciate against the dollar and on 1 January 20x5 Cambell entered into a 12-

month forward contract to sell FC 2,240,000 to hedge the investment. The equity section of OGRE Inc’s statement of financial position as at 31 December 20x4 is as follows.

Information on relevant exchange rates is given below:

![]()

Cambell designated the forward contract as a hedge of the net investment in OGRE and excluded the time value of the forward contract from the hedging relationship. Ignore discounting. Cambell Corporation’s financial year ends on 30 September. Cambell’s functional currency is the dollar.

Required

1. Prepare journal entries to record all the transactions pertaining to the derivatives and the hedged items from 1 January 20x5 to 30 September 20x5.

2. Show the effects of the transactions in the financial statements of Cambell Corporation for the financial year ending 30 September 20x5.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah