Atticus Ltd, whose functional currency is the dollar, purchased 100,000 shares of Scotts Corporation (a foreign company

Question:

Atticus Ltd, whose functional currency is the dollar, purchased 100,000 shares of Scotts Corporation (a foreign company listed in country X whose currency is the LC) at a price of LC 2.80 per share when the spot exchange rate was LC 1 to $1.28 on 1 October 20x4. Atticus Ltd classified the long term equity investment as fair value to other comprehensive income (FVOCI). The share price of Scotts Corporation on 31 December 20x4 was LC 3.00 and the spot exchange rate was LC 1 = $1.21. Atticus Ltd’s financial year-end is 31 December. The following additional information is available:

(a) On 1 November 20x4, the price of Scotts Corporation’s share had risen to LC 2.85. Atticus Ltd entered into a contract with a bank to sell forward LC 285,000 for delivery on 31 March 20x5. The spot exchange rate was LC 1 to $1.25 and the forward rate on the contract was LC 1 to $1.23. The purpose of the contract was to hedge the foreign currency risk associated with the investment in Scotts Corporation as Atticus Ltd anticipated a possible depreciation of the LC vis-à-vis the dollar.

(b) On 31 December 20x4, Atticus Ltd purchased a put option on 100,000 units of Scotts Corporation shares with a strike price of LC 3.00. The purpose of the put option was to hedge against a decrease in the share price of Scotts Corporation below LC 3.00. The option expired on 30 June 20x5.

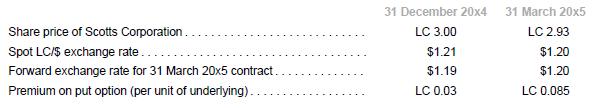

The following information on the price of Scotts Corporation shares, the $/LC exchange rates and the premium on the put option is available:

Atticus settled the forward contract on a net basis at the maturity date and continued to hold the shares in Scotts Corporation. On 30 June 20x5, Atticus Ltd closed the option position and sold off all the shares at the prevailing market price of LC 2.85 when the spot exchange rate was LC 1 to $1.21.

Required

Assume that all hedge accounting requirements are met and Atticus designates the option contract and the forward contract as fair value hedges of the price and foreign exchange risk. Atticus excludes the time value element from the hedging relationships in both contracts. Show the journal entries pertaining to the forward contract and the put option on the following dates:

(a) 1 November 20x4

(b) 31 December 20x4

(c) 31 March 20x5

(d) 30 June 20x5 Show workings and include brief narratives. Ignore discounting of the forward contract.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah