Entity C prepares its financial statements on 31 December each year. On 1 January 2005, the entity

Question:

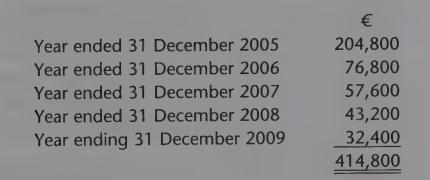

Entity C prepares its financial statements on 31 December each year. On 1 January 2005, the entity acquired a non-current-asset at a cost of EUR 512,000 and decided to depreciate this asset on a straight-line basis over a five-year period, assuming a residual value of EUR nil. Depreciation allowed for tax purposes with regard to this asset in the first five years of ownership is as follows:

The entity’s pretax profit (after charging depreciation) was EUR 1m for the . year ended 31 December 2005 and remained at a consistent EUR 1m per annum for each of the next four years.

There are no other non-current assets and there are no differences between taxable profit and accounting profit other than those relating to depreciation. A tax rate of 20 per cent applies throughout.

(a) Without making use of the ‘tax base’ concept, show the necessary transfers to and from the deferred tax account for each of the five years ended 31 December 2009. Also cal¢ulate and explain the closing balance on this account at 31 December 2009.

(b) Re-work this exercise using the tax base concept.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone