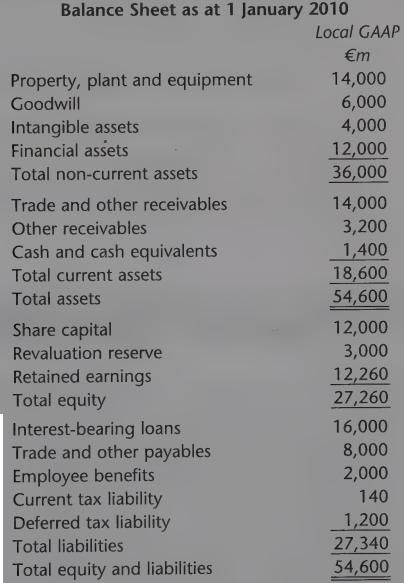

For entity F, you are given the following information: (a) Tax bases of the above assets and

Question:

For entity F, you are given the following information:

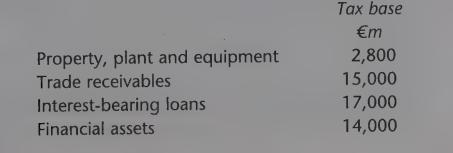

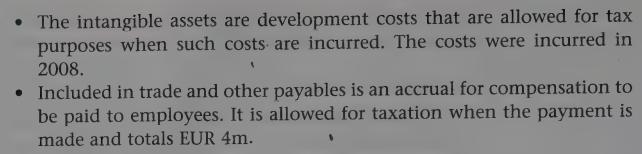

(a) Tax bases of the above assets and liabilities are the same as their carrying amounts except for:

(b) During 2005, a building was revalued. On 1 January 2010 the revaluation reserve in respect of this building was EUR 3,000.

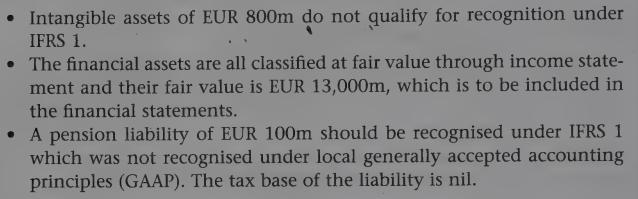

(c) The following adjustments to the financial statements should be made to comply with IFRS 1 — First-Time Adoption of IFRS, on 1 January 2010:

(d) The entity is very likely to be profitable in the future. Calculate the deferred tax provision ‘as at 1 January 2010, showing the amount of the adjustment required to the deferred tax provision and any amounts to be charged to revaluation reserve.

(Assume a tax rate of 30 per cent.)

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone