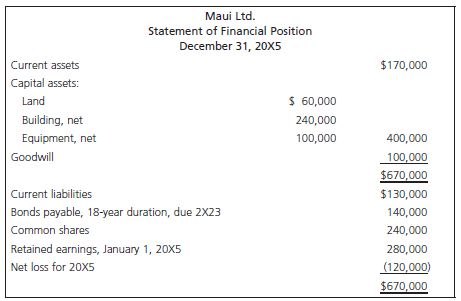

Maui Ltd. has the following SFP at December 31, 20X5. On January 1, 20X6, Oahu Ltd., whose

Question:

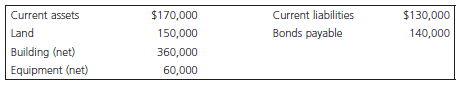

On January 1, 20X6, Oahu Ltd., whose assets are composed entirely of share investments and cash, paid $371,000 for 70% of the outstanding shares of Maui Ltd. The current fair values of the net assets of Maui Ltd. on January 1, 20X6, were:

Oahu Ltd. had the following shareholders€™ equity on January 1, 20X6:

Common shares....................................$ 960,000

Retained earnings.................................1,420,000

...............................................................$2,380,000

Required

1. Assume that a consolidated SFP is prepared on January 1, 20X6. Calculate the dollar amounts for the following items as they would appear on that consolidated SFP under the entity method:

i. goodwill;

ii. land;

iii. equipment;

iv. common shares;

v. retained earnings; and

vi. NCI.

2. What does NCI represent on the consolidated SFP?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay