On January 1, 20X5, Huge Ltd. purchased 80% of the shares of Tiny Ltd. for $2,100,000 and,

Question:

There were no intercompany transactions.

Required

Calculate the balance of non-controlling interest as it would be shown on the consolidated SFP of Huge Ltd. at December 31, 20X5, under the entity method.

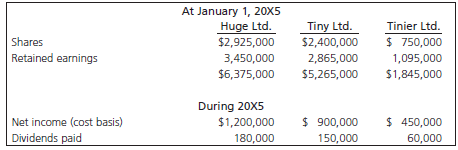

At January 1, 20X5 Huge Ltd. Tinier Ltd. $ 750,000 1,095,000 $1,845,000 Tiny Ltd. Shares Retained earnings $2,925,000 $2,400,000 $6,375,000 $5,265,000 During 20X5 $ 450,000 60,000 Net income (cost basis) Dividends paid $ 900,000 $1,200,000 180,000 150,000

Step by Step Answer:

Noncontrolling interest on Huges consolidated statement of financial position will consist of two co...View the full answer

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Related Video

It is the equity interest of outside investors other than of parent. In other words it is the equity in a subsidiary not attributable, directly or indirectly, to a parent. Non-controlling interest should be presented in the consolidated statement of financial position within equity, separately from the parent shareholders\' equity.

Students also viewed these Business questions

-

On January 1, 20X5, Pop Company of Regina, Saskatchewan, purchased 80% of the out-standing shares of Soda Limited of Switzerland. Sodas statements of financial position as at December 31, 20X4, and...

-

On January 1, 20X5, Pond Corporation acquired 80 percent of Skate Company's stock by issuing common stock with a fair value of $180,000. At that date, Skate reported net assets of $150,000. The fair...

-

Broom Manufacturing used cash to acquire 75 percent of the voting stock of Satellite Industries on January 1, 20X3, at underlying book value. At that date, the fair value of the noncontrolling...

-

State with reasons, whether the following statements are true or false : (i) Overhauling expenses for the engine of motor car to get better fuel efficiency is revenue expenditure. (ii) Depreciation...

-

Fourteen percent of U.S. residents are in their twenties. Consider a group of eight U.S. residents selected at random. In following Exercises, find the probabilities that the number of people in the...

-

Balance the following oxidation-reduction equations. The reactions occur in acidic or basic aqueous solution, as indicated. a. MnO4 + I MnO2 + IO3 (basic) b. Cr2O72 + Cl Cr3+ + Cl2 (acidic) c. S8 +...

-

The bank of tube at the back of a domestic refrigerator of vapour compression type is (a) evaporator (b) condenser (c) capillary (d) electric wire

-

The Mystic Coffee Shop blends coffee on the premises for its customers. It sells three basic blends in one-pound bags: Special, Mountain Dark, and Mill Regular. It uses four different types of coffee...

-

Create a table with two columns comparing leadership and followership with at least five characteristics for both. What are some of the formal and informal roles of leadership and followership? What...

-

The bar codes above represent locations in a warehouse. How many units would be left in each location? If you picked 250 units from location 00000113774360000 If you picked 250 units from location 00...

-

Maui Ltd. has the following SFP at December 31, 20X5. On January 1, 20X6, Oahu Ltd., whose assets are composed entirely of share investments and cash, paid $371,000 for 70% of the outstanding shares...

-

Parent Ltd. pays $553,000 cash for 70% of the outstanding voting shares of Sub Ltd. on January 1, 20X5. The following information was available: During 20X5, Sub Ltd. earned $180,000 and paid no...

-

Draw a stereoisomer of trans-1, 3-climethylcyclobutane.

-

A case study analysis requires you to investigate a business problem, examine solutions and propose a recommendation based on research.. Prepare a case study for BP Texas City.

-

A wooden crate is pulled up a ramp that is 2.0 m high and 10.0 m long. The crate is attached to a rope that is wound around an axle with a radius of 0.25 m. The axle is turned by a 1 m long handle....

-

Find the area of the shaded region. ... 4 ft 8 ft 1 ft 1 ft 1 ft

-

As an HR manager, you have heard rumors about potential efforts to unionize your warehouse employees. Using online resources, prepare a short list of guidelines (at least three points) hto help...

-

Based on your work above, compete the Income Statement through Gross Profit for PDI Do not use the dollar sign ( $ ) . Use whole numbers only ( no decimal places ) . PDI Income Statement Account...

-

Consider the line f(x) = mx + b, where m and b are constants. Show that f'(x) = m for all x. Interpret this result.

-

1. Following are information about Alhadaf Co. Cost incurred Inventory Purchases Sales Adverting expense Salary Expense Depreciation Beginning Inventory Ending Inventory Amount 118,000 350.000 90,000...

-

Slanted Building Supplies purchased 32 percent of the voting shares of Flat Flooring Company in March 20X3. On December 31, 20X3, the officers of Slanted Building Supplies indicated they needed...

-

Slanted Building Supplies purchased 32 percent of the voting shares of Flat Flooring Company in March 20X3. On December 31, 20X3, the officers of Slanted Building Supplies indicated they needed...

-

Most Company purchased 90 percent of the voting common stock of Port Company on January 1, 20X4, and 15 percent of the voting common stock of Adams Company on July 1, 20X4. In preparing the financial...

-

John Adams plans to retire at the age of 62. He wants an annual income of $60,000 per year. John is currently 45 years of age. How much does he have to place at the beginning of each year into a...

-

Assume that four years and one month from today you plan to make the first of several annual withdrawals from an account. Your first withdrawal will equal $1000. You plan for these withdrawals to...

-

If I borrowed 15,000 in student loans at an annual interest of 7%. and then repay $1800 per year, then how long will it take me to repay the loan?

Study smarter with the SolutionInn App