On 1 January 20x4, Company P acquires 70% of Company S for cash consideration amounting to $35

Question:

On 1 January 20x4, Company P acquires 70% of Company S for cash consideration amounting to $35 million. The fair value of the identifiable net assets of Company S as at the date of acquisition is $28 million. In connection the acquisition, Company P and the non-controlling interests entered into a pair of asymmetrical call and put options over the remaining 30% shares held by the non-controlling interests. In particular, Company P grants the noncontrolling interests a put option to require itself to purchase the 30% in Company S based on the terms and conditions set out in the put option agreement when the put option is exercised. The non-controlling interests on the other hand, grants Company P a call option to require the non-controlling interests to sell their 30% in Company S at the exercise price and terms and conditions as agreed in the call option agreement.

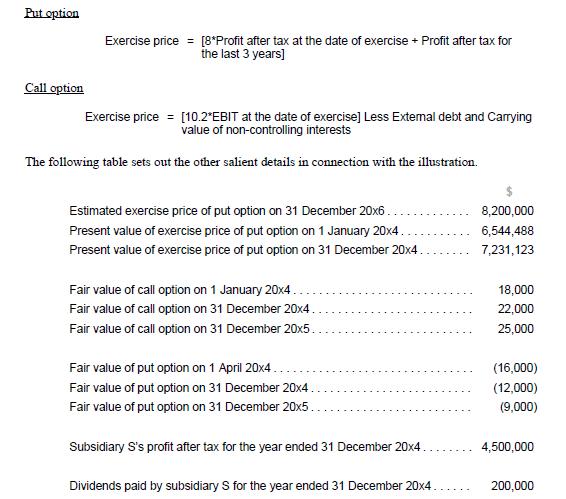

The terms in the call and put option do not mirror each other. The call option can only be exercised by Company P on 1 January 20x4 until the expiry date of the call option which is on 31 December 20x6. The put option, on the other hand can only be exercised from 1 April 20x4 to the date of expiry which is 30 June 20x7. Both options can only be settled via physical delivery. Upon the exercise of the option by either party, the other option will lapse. The exercise price is determined by the following formula

The terms in the call and put option agreements do not allow any adjustment to be made to the exercise price when dividend is paid by Company S. The rights associated with the underlying shares such as voting rights and the right to receive dividends remain with the non-controlling interest. The excess of fair value over the net carrying value of the assets in Company S at the date of acquisition relates to an intangible asset with indefinite useful life. There is no impact on the post-acquisition profits on the group as the intangible asset with indefinite useful life remains unimpaired for FY20x5.

On 31 December 20x14, Company P exercised the call option and paid $6,500,000 based on the exercise price computed on the date of exercise. Taxes are ignored for the purpose of this problem. Company P’s accounting policy for non-controlling interests is to measure them at their proportionate share of the recognized fair value of the acquiree’s identifiable net assets at the date of acquisition in accordance with IFRS 3. It is also further assumed that Company P has concluded based on an assessment of the terms and conditions of the options that it does not have, in substance, an existing ownership interest over the shares held by the non-controlling shareholders. The financial year end for both Company P and S is December. Prepare the accounting entries for 20x14.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah