On 30 June 20x8, Company P acquires 90% of Company S for cash consideration amounting to $3

Question:

On 30 June 20x8, Company P acquires 90% of Company S for cash consideration amounting to $3 million. The fair value of the identifiable net assets of Company S as at the date of acquisition is $2.8 million. In connection with the acquisition of Company S, Company P and the non-controlling interests entered into an agreement in which Company P wrote a put option over the 10% shares held by the non-controlling interests. The put option can be exercised by the non-controlling interests at any point in time from 30 June 20x8 to 30 June 20x9 and it can only be settled via physical delivery. Upon exercise of the put option by the non-controlling interests, Company P is required to purchase the entire 10% shares held by the non-controlling interests for a fixed price of $800,000.

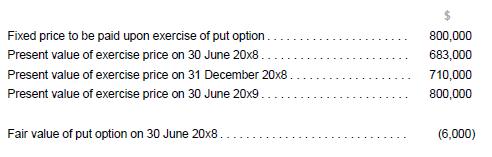

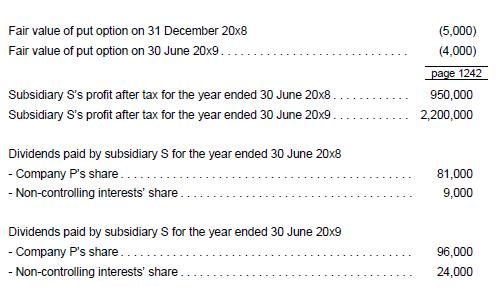

The following table sets out the other salient details in connection with the illustration.

For the purpose of this question, the terms in the put option agreement do not allow any adjustment to be made to the exercise price when dividend is paid by Company S. It is further assumed that the excess of fair value over the net carrying value of the assets in Company S at the date of acquisition relates to an intangible asset with indefinite useful life. There is no impact on the post-acquisition profits for the group as the intangible asset with indefinite useful life remains unimpaired for both years ended 30 June 20x8 and 20x9.

On 30 June 20x9, the non-controlling shareholders exercised the written put option. Taxes are ignored for the purpose of this illustration. Company P has determined the appropriate discount rate for the redemption liability to be 10%. The financial year of Company P and Company S is June.

Analyze if the put option entered into provide Company P with current access to returns on the 10% held by non-controlling interests and work out the accounting entries for the transaction for both 30 June 20x8 and 30 June 20x9 in both the separate and consolidated financial statements of Company P.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah