On 1 January 20x6, P purchased 80% of the equity of S from Ss existing owners. The

Question:

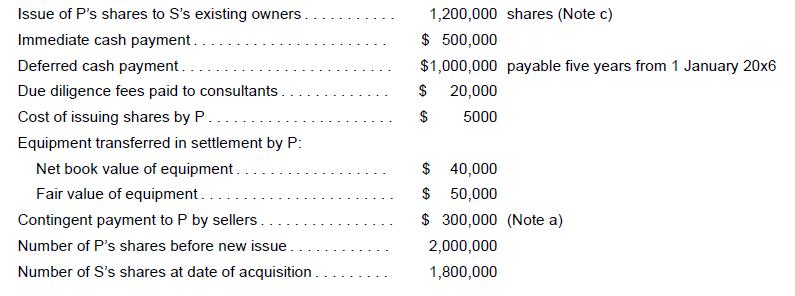

On 1 January 20x6, P purchased 80% of the equity of S from S’s existing owners. The following transactions arose on or just prior to the acquisition date.

Additional information:

(a) The existing owners of S undertook to pay P an amount of $300,000 if the profit of S falls below $1,000,000 per year in 20x6 and 20x7. Average profit after tax of S had exceeded $1,500,000 in the last five years and there are no indications that profit will decline in the future.

(b) P’s effective interest rate was 5% per annum.

(c) At the date of exchange of shares:

(i) The fair value of the equity of P was $4,000,000.

(ii) The fair value of the equity of S was $3,200,000.

The fair value of S includes the fair values of goodwill and identifiable net assets as at the date of acquisition.

The fair value of P includes the effects of the acquisition of S. The fair value of non-controlling interests as at acquisition date was $640,000.

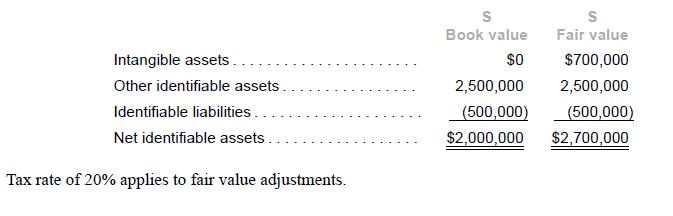

(d) The book and fair values of S’s identifiable net assets on 1 January 20x6 are as follows:

Required:

1. Determine the fair value of consideration transferred in accordance with IFRS 3 Business Combinations if a proportional interest of P’s fair value is the most reliable measure of the shares issued by P. Identify the specific components of consideration transferred.

2. Determine the fair value of consideration transferred in accordance with IFRS 3 Business Combinations if a proportional interest of S’s fair value is the most reliable measure of the shares acquired by P. Identify the specific components of consideration transferred.

3. Assuming that the fair value of P is used to determine the fair value of shares issued (that is, (1)

above), prepare the journal entries in P’s books to record the investment in S and the other transactions entered into on 1 January 20x6.

4. Assuming (1) above, prepare the consolidation entry to eliminate the investment in S and to recognize the goodwill and fair value adjustment(s).

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah