P Co is keen to acquire the business of S Co on 1 January 20x1 and it

Question:

P Co is keen to acquire the business of S Co on 1 January 20x1 and it can do so in one of two ways. P Co will issue shares with fair value of $700,000 as settlement for the acquisition under each alternative.

(a) Alternative 1: P Co acquires 100% of the net assets (including cash) of S Co through a purchase agreement with S Co.

(b) Alternative 2: P Co acquires 100% of the ownership interest of S Co from the owners of S Co.

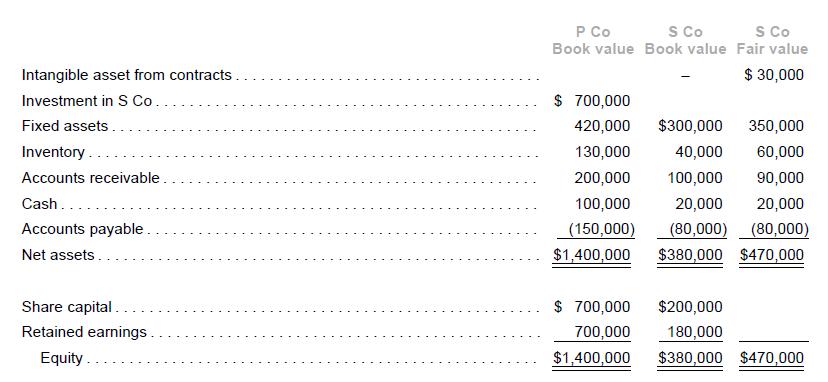

Details of the net assets of P Co and S Co on 1 January 20x1 are shown below. Tax rate is 20%. Recognize the deferred tax effects, if any, on the difference between the fair value and the book value of identifiable net assets.

1. Under Alternative 1, show the journal entry to record the purchase of net assets of S Co by P Co in its separate financial statements on 1 January 20x1.

2. Under Alternative 2, show the journal entry to record the acquisition in P Co’s separate financial statements on 1 January 20x1.

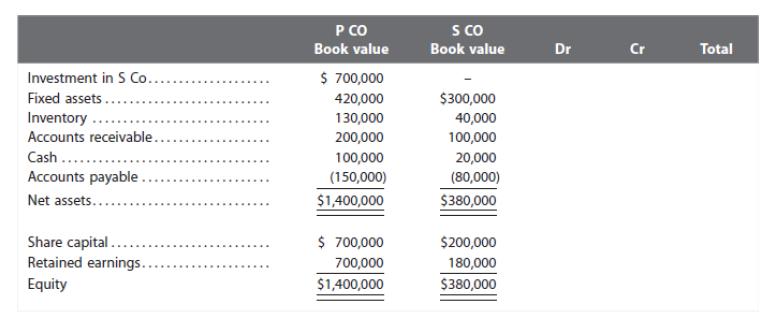

3. Under Alternative 2, complete the consolidation worksheet below to show the group statement of financial position on 1 January 20x1.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah