On 1 July 2007, Vancouver Ltd leased a photocopier from Kamloops Ltd, a company that manufactures, retails

Question:

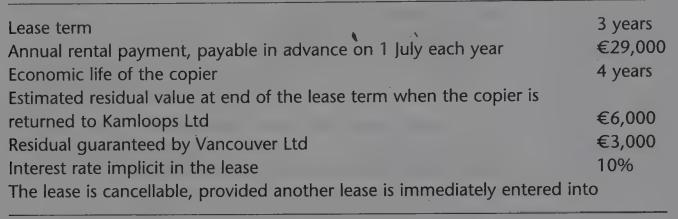

On 1 July 2007, Vancouver Ltd leased a photocopier from Kamloops Ltd, a company that manufactures, retails and leases copiers. The photocopier had cost Kamloops Ltd EUR 60,000 to make but had a fair value on 1 July 2007 of EUR 70,160. The lease agreement contained the following provisions:

The annual payment included an amount of EUR 5,000 per annum to reimburse Kamloops Ltd for the cost of paper and toner supplied to Vancouver Ltd. Kamloops Ltd’s solicitor prepared the lease agreement for a fee of EUR 2,730.

At the end of the lease term on 30 June 2010, Vancouver Ltd returned the copier to Kamloops Ltd, who sold the copier for EUR 6,000.

(a) Classify the lease for both the lessor and the lessee. Explain your answer.

(b) Prepare the following:

(i) For the lessee: the lease payment schedule and the journal entries for the year ended 30 June 2010.

(ii) For the lessor: the lease receipts schedule and the journal entries for the year ended 30 June 2008.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone