On 2 January 20x4, P Co acquired controlling interest in 90% of Topaz Co through the following

Question:

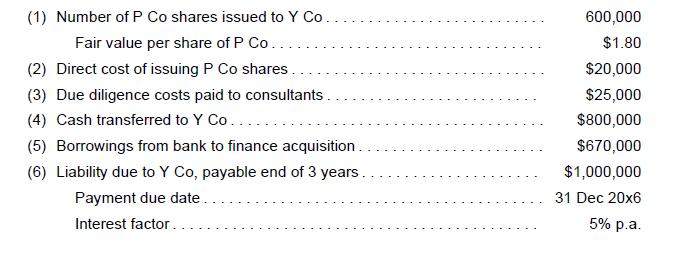

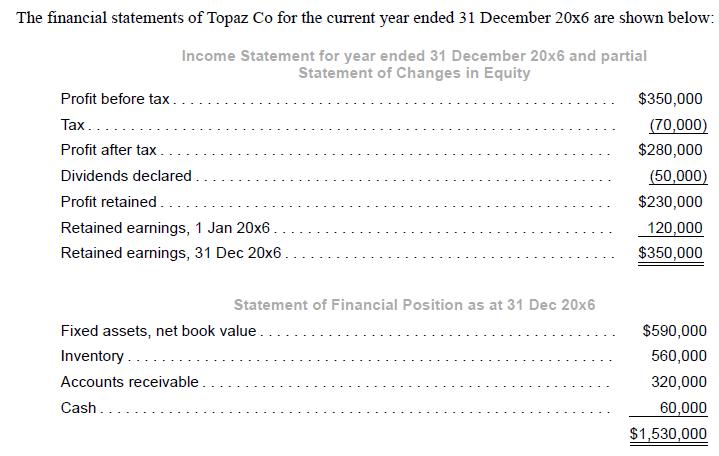

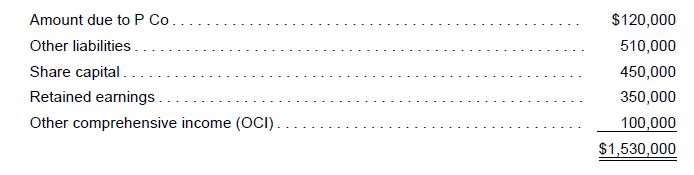

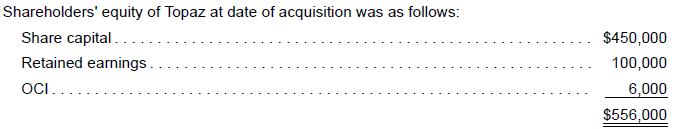

On 2 January 20x4, P Co acquired controlling interest in 90% of Topaz Co through the following transfers to Y Co, the former owners of Topaz. P Co expects significant synergies from Topaz Co’s possible licensing rights expected in 20x5. Financing and other transactions are also shown below:

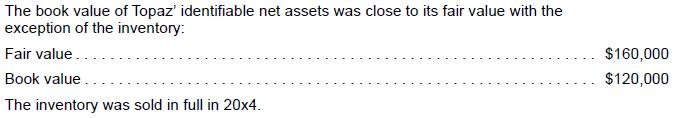

Additional information:

(a)

(b)

(c) The fair value of non-controlling interests of Topaz as at acquisition date was $188,000.

(d) The balance of other comprehensive income as at 1 January 20x6 was $67,000.

(e) Assume a tax rate of 20%.

Required:

1. Prepare the journal entries to record the investment in Topaz, transaction costs, financing transactions and other entries in P Co’s books on 2 January 20x4. Recognize unamortized discount separately for future settlements.

2. Record the following transactions in P Co’s books for the year ended 31 December 20x6:

i. Interest expense on long-term loan payable in 20x6;

ii. Settlement of loan payable on 31 December 20x6.

3. Explain briefly the reason for not recognizing the possible licensing right as an intangible asset as at 2 January 20x4.

4. Prepare consolidation entries for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IFRS 3 and IFRS 10.

5. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x6, showing the workings clearly.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah