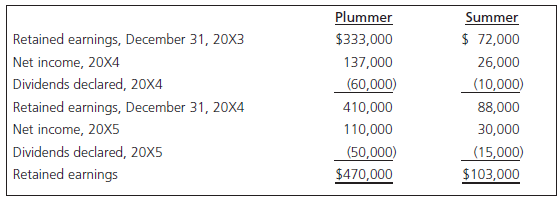

On December 31, 20X3, Plummer Company acquired 70% (7,000 common shares) of Summer Company for $950,000. On

Question:

During 20X4, Plummer sold merchandise inventory to Summer for $72,000. On December 31, 20X4, a portion of inventory remained unsold. An unrealized profit of $15,000 remained in this ending inventory.

On January 1, 20X5, Plummer sold 1,000 of its shares of Summer for $150,000.

Required

a. Determine consolidated net income for the year ended December 31, 20X4.

b. Determine how the sale of the 1,000 shares of Summer by Plummer in 20X5 should be reported.

c. Determine consolidated retained earnings at December 31, 20X5.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: