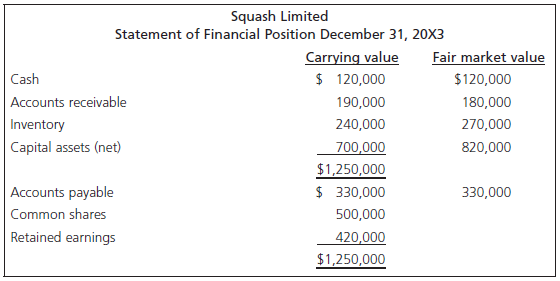

On January 1, 20X3, Pumpkin Company acquired 70% of the 10,000 outstanding voting shares of Squash Limited

Question:

The capital assets had a remaining useful life of 20 years. There has been no impairment of goodwill since the date of acquisition. Squash had a net income of $50,000 for the year ended December 31, 20X3, and $80,000 for the year ended December 31, 20X4. Squash paid dividends of $5,000 in 2003 and paid dividends of $10,000 in 2004.

On January 1, 20X5, Pumpkin sold 1,000 of the Squash shares for $130,000.

Required

a. Calculate the balance in the investment in the Squash account before and after the sale of the 1,000 shares, assuming Pumpkin uses the equity method.

b. Calculate the positive/negative adjustment to equity on the sale of the 1,000 shares.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay