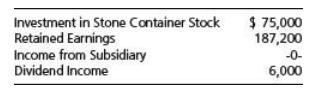

On December 31, 20X4, Bennett Corporation recorded the following entry on its books to adjust its investment

Question:

On December 31, 20X4, Bennett Corporation recorded the following entry on its books to adjust its investment in Stone Container Company stock from the basic equity method to the fully adjusted equity method:

Required

a. Adjust the data reported by Bennett in the trial balance contained in Problem P8-24 for the effects of the preceding adjusting entry.

b. Prepare the journal entries that would have been recorded on Bennett's books during 20X4 under the fully adjusted equity method.

c. Prepare all eliminating entries needed to complete a consolidation workpaper as of December 31, 20X4, assuming Bennett has used the fully adjusted equity method.

d. Complete a three-part consolidation workpaper as of December 31, 20X4.

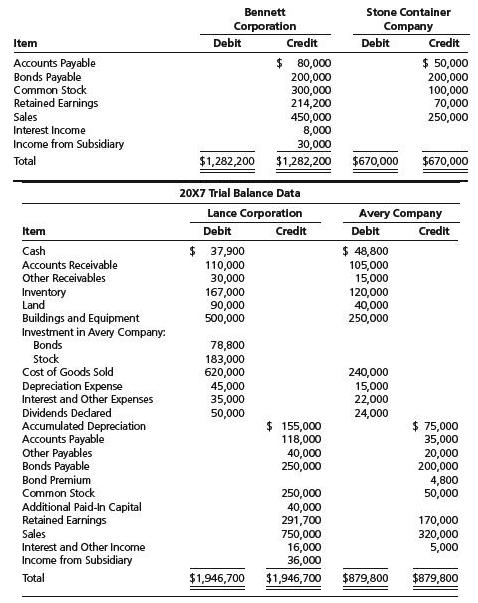

Data From in P8-24

Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Stone. On December 31, 20X3, Bennett purchased $100,000 par value bonds of Stone. Stone originally issued the bonds at par value. The bonds’ coupon rate is 9 percent. Interest is paid semiannually on June 30 and December 31. Trial balances for the two companies on December 31, 20X4, are as follows:

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0073526911

8th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey