On December 31, 20X6, Retail Ltd. purchased 100% of the outstanding shares of Supply Corporation by issuing

Question:

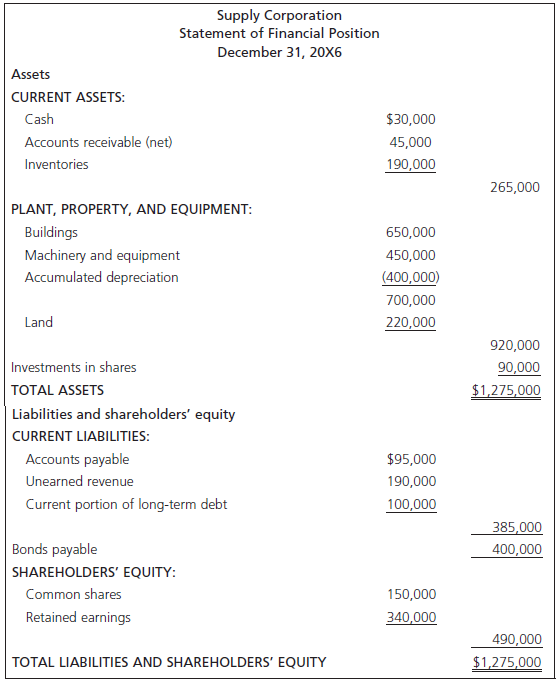

The SFP for Supply Corporation at the date of acquisition is shown below, together with estimates of the fair values of Supply€™s recorded assets and liabilities. In addition, Supply held exclusive Canadian rights to certain production processes; the fair value of these rights was estimated to be $196,000.

Required

Explain what values should be assigned to Supply Corporation€™s assets and liabilities when Retail Ltd. prepares its consolidated financial statements (including goodwill, if any).

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: