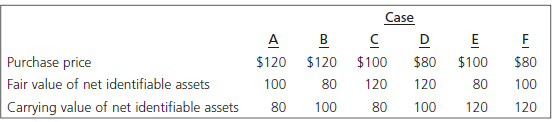

Refer to P 3-2 in the main chapter. For each of the six independent cases, assume that

Question:

Refer to P 3-2 in the main chapter.

For each of the six independent cases, assume that the tax base of the net identifiable assets is equal to their carrying value (i.e., no temporary differences exist between the two, and as such related deferred taxes are zero). Assume that the relevant future tax rate is 30%.

Required

For each independent case, make the appropriate deferred tax adjustment required in relation to the fair value adjustment allocated to the net identifiable assets, and calculate the goodwill/gain from bargain purchase.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: