On January 1, 20X1, Rodriguez Inc. purchased 100% of the common shares of Teresa Inc., for $325,000.

Question:

Fair value€“carrying value differences

Land...................................................................($75,000)

Buildings (net).......................................................35,000

Equipment (net)..................................................(45,000)

Notes payable.......................................................15,000

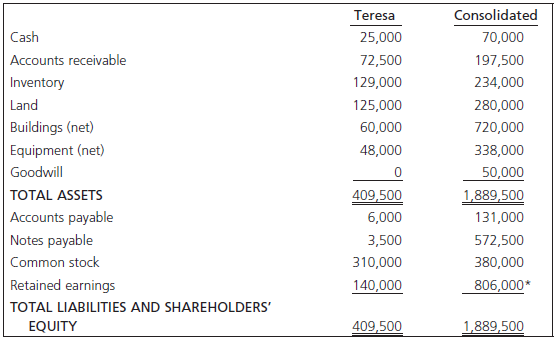

The separate entity SFP of Teresa and the consolidated SFP of Rodriguez Inc. on January 1, 20X1, are presented below. The consolidated SFP of Rodriguez was prepared following the acquisition method.

Required

Prepare the January 1, 20X1, separate-entity SFP of Rodriguez Inc. Show all supporting calculations.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay