On January 1, 20X2, Plend Corporation acquired all of Stork Corporations assets and liabilities by issuing shares

Question:

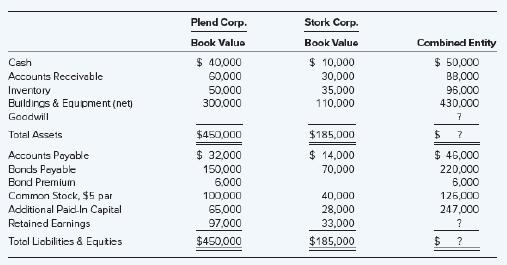

On January 1, 20X2, Plend Corporation acquired all of Stork Corporation’s assets and liabilities by issuing shares of its common stock. Partial balance sheet data for the companies prior to the business combination and immediately following the combination are as follows:

Required

a. What number of shares did Plend issue to acquire Stork’s assets and liabilities?

b. What was the total market value of the shares issued by Plend?

c. What was the fair value of the inventory held by Stork at the date of combination?

d. What was the fair value of the identifiable net assets held by Stork at the date of combination?

e. What amount of goodwill, if any, will be reported by the combined entity immediately following the combination?

f. What balance in retained earnings will the combined entity report immediately following the combination?

g. If the depreciable assets held by Stork had an average remaining life of 10 years at the date of acquisition, what amount of depreciation expense will be reported on those assets in 20X2?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781265042615

13th International Edition

Authors: Theodore E. Christensen, David M. Cottrell, Cassy Budd