On January 2, 20X8, Photo Corporation acquired 75 percent of Shutter Companys outstanding common stock. In exchange

Question:

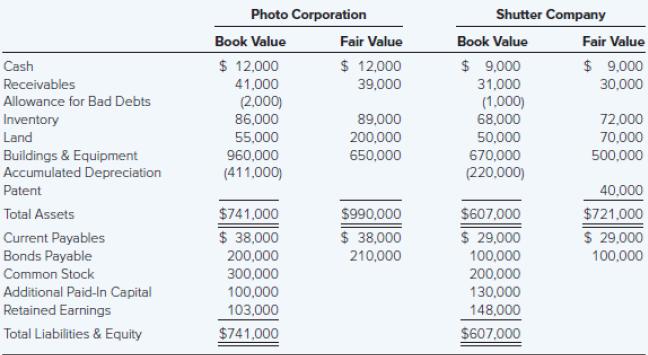

On January 2, 20X8, Photo Corporation acquired 75 percent of Shutter Company’s outstanding common stock. In exchange for Shutter’s stock, Photo issued bonds payable with a par value of $500,000 and fair value of $510,000 directly to the selling stockholders of Shutter. At that date, the fair value of the noncontrolling interest was $170,000. The two companies continued to operate as separate entities subsequent to the combination. Immediately prior to the combination, the book values and fair values of the companies’ assets and liabilities were as follows:

At the date of combination, Shutter owed Photo $6,000 plus accrued interest of $500 on a short-term note. Both companies have properly recorded these amounts.

Required

a. Record the business combination on the books of Photo Corporation.

b. Present in general journal form all consolidation entries needed in a worksheet to prepare a consolidated balance sheet immediately following the business combination on January 2, 20X8.

c. Prepare and complete a consolidated balance sheet worksheet as of January 2, 20X8, immediately following the business combination.

d. Present a consolidated balance sheet for Photo and for Shutter as of January 2, 20X8.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd