Phone Corporation acquired 70 percent of Smart Corporations common stock on December 31, 20X4, for $102,200. At

Question:

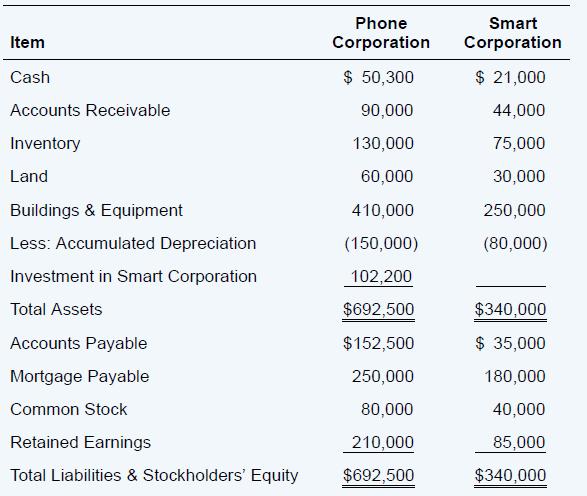

Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $102,200. At that date, the fair value of the noncontrolling interest was $43,800. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of $81,000, and buildings and equipment, which had a fair value of $185,000. At December 31, 20X4, Phone reported accounts payable of $12,500 to Smart, which reported an equal amount in its accounts receivable.

Required

a. Give the consolidation entry or entries needed to prepare a consolidated balance sheet immediately following the business combination.

b. Prepare a consolidated balance sheet worksheet.

c. Prepare a consolidated balance sheet in good form.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd